A virtuous circle to a vicious cycle in emerging markets

What does the yield on a 3 month US T Bill have to do with the price of a holiday in Argentina? Plenty, if you follow the chain of events that have driven capital flows since the 2008 financial crisis.

Given the noise in emerging markets over this month, it’s an opportune time to revisit a theme we discussed in our April commentary (“QE Winners Become QT Losers“).

We’ve noted previously that the transition from Quantitative Easing (QE) to Quantitative Tightening (QT) is one of the most important paradigm shifts currently taking place in markets.

EM assets had been a big beneficiary of the yield seeking flood of money that QE unleashed. A virtuous circle ensued whereby inflows pushed up asset prices, suppressed volatility, generated strong returns and encouraged yet more inflows.

Additionally, EM governments and companies took advantage of low rates to raise foreign currency debt and investors were very happy to oblige. For example, in June last year Argentina issued USD2.75bn of 100 year bonds in what was a very popular deal at the time.

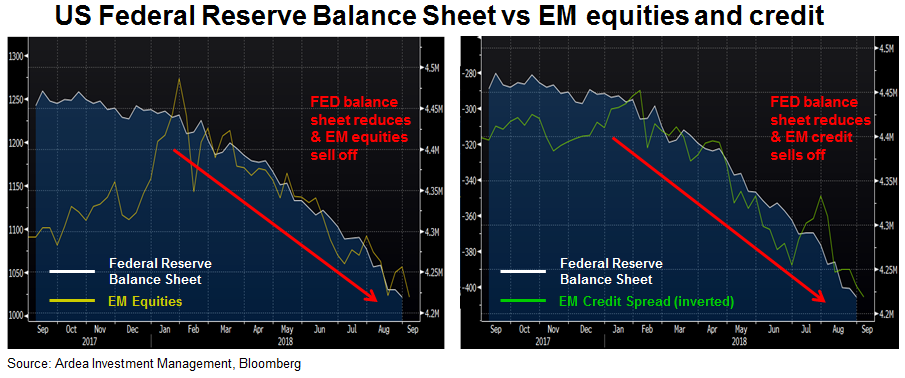

But now that dynamic is reversing as the US Federal Reserve (FED) raises interest rates and reduces its balance sheet (i.e. QT).

Since QT gained momentum in February this year and FED balance sheet reduction accelerated, emerging market assets have been hit hard. For example, the MSCI EM equity index has dropped 19% and the EMBI bond index has dropped 6% from a combination of credit spread widening and interest rates rising.

And that Argentina bond is no longer so popular. As interest rates have risen and Argentina’s economic fundamentals have worsened, the bond is now down 30% over the past 8 months.

Which brings us to 3 month US T Bills. As they now yield over 2%, and other related government bond yields have risen, the prospect of continuing to reach for yield by lending to EM credits at historically low risk premia becomes much less appealing (refer to – ‘The Most Important Chart You’ve Ignored’ for details).

So, that virtuous circle now risks turning into a vicious cycle of capital outflows leading to falling asset prices, higher volatility, FX depreciation and stressed balance sheets, all driving even more outflows.

The focus so far has been on countries like Argentina, which have the weakest economic situations and have been forced to raise interest rates to defend their currencies. Argentina has so far hiked its key central bank interest rate to a massive 60% but that still hasn’t stopped the Argentine peso from depreciating by 87% in the past 4 months.

At least that makes a holiday to Argentina a lot cheaper, and with November being Jacaranda season in Buenos Aires, it’s the ideal time to start planning your trip.

Ardea Investment Management