Bond yields can be misleading

How can a negative yield bond deliver a positive return, or a positive yield bond deliver a loss?

Those used to conventional bond investments tend to focus on a bond portfolio’s yield as a proxy for its expected return. This approach works best when yields are relatively high and bond prices are stable. At other times yield can be a misleading indicator of expected return.

We’re now in an environment that poses challenges for conventional bond investing. Ultra-low bond yields, high bond price volatility, uncertainty about bond market direction. At times like this a bond portfolio’s yield can diverge substantially from the actual return it ends up delivering.

To make more informed decisions about fixed income investments it’s important to look beyond yield and understand the other factors that drive bond returns. Looking not to the past but to the future, simply relying on yield as a proxy for expected returns is no longer good enough.

What does yield mean?

Ignoring technical nuances, yield – often referred to as running yield or yield to maturity – represents the return from holding a bond, assuming the bond price remains unchanged. It comprises the interest income paid by the bond plus any discount or premium embedded in the bond purchase price.

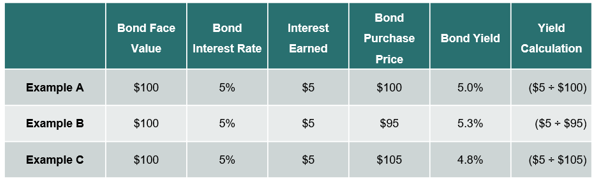

For example, a bond issued with a face value of $100 and an interest rate of 5% p.a. will deliver annual interest income of $5 (i.e. $100 face value x 5%). Assuming the bond was purchased for $100, the bond yield is 5% (i.e. $5 income ÷ $100 purchase price). If that same bond was purchased at a discount to its $100 face value, the yield would be higher.

For example, if the same bond was purchased for $95, it would still deliver annual interest income of $5 because interest is calculated based on the bond’s original face value. However, because the investor only paid $95 rather than $100, the yield is now 5.3% rather than 5% (i.e. $5 interest income ÷ $95 purchase price). The yield would be lower if the bond was purchased for a higher price, as shown in the table below.

While ignoring some technical nuances, these stylised examples still demonstrate the underlying principle that a bond’s yield is determined by the interest income earned from the bond, as well as any discount or premium embedded in the original purchase price.

In all three examples the bond’s yield can be calculated at the time of purchase and, assuming the bond price remains unchanged, this yield will be the same as the actual return earned from holding that bond over a given period.

The assumption of unchanged bond price is crucial because a bond’s return over a given period will only equal its initial yield if the bond price is unchanged. In reality however, bond prices constantly fluctuate, which means this crucial assumption doesn’t actually hold in practice. *

What happens when bond prices fluctuate?

Just like stocks, prices of liquid bonds (i.e. those that are actively traded) constantly fluctuate as a diverse range of market participants continually buy and sell based on their investment objectives, interest rate expectations, macroeconomic views etc.

It is these real-world price fluctuations that can make yield a misleading indicator of the actual return that a bond investment delivers over a given period. This can be confusing for investors used to thinking about bonds purely in terms of the interest income they generate – after all they are called ‘fixed income’ investments.

However, the interest income (i.e. yield) is just one component of the total return from investing in bonds, with bond price fluctuations being the other. This is why even zero or negative yield bonds can still deliver positive total returns, while bonds with high yields can actually deliver negative returns over a given time horizon.

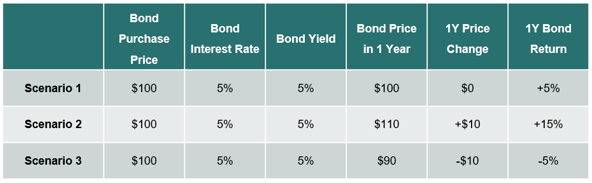

Using example A from earlier, the 3 scenarios below show how yield and total return diverge as bond prices change. In all scenarios, the total return is the sum of the yield and the price change.

Again, these stylised examples ignore some technical nuances, but still demonstrate the underlying principle that fluctuating bond prices can deliver return outcomes that are very different to the yield calculated at the time of investing.

- Scenario 1: Bond price remains unchanged; therefore the yield and return are the same.

- Scenario 2: Bond price increases by $10; therefore the total return over 1 year is the sum of interest earned ($5) and bond price change (+$10), resulting in a total return of 15% (i.e. $15 ÷ $100 purchase price). In this case the bond price rise adds to the total return.

- Scenario 3: Bond price decreases by $10; therefore the total return over 1 year is the sum of interest earned ($5) and bond price change (-$10), resulting in a total return of -5% (i.e. -$5 ÷ $100 purchase price). In this case the bond price fall is large enough to more than wipe out all the interest income earned over the year, resulting in a loss for the investor.

In these stylised examples the 5% bond yield is still a material component of the total return. In the real world, given how low bond yields have fallen, there are many examples where the yield has become insignificant and therefore bond returns are dominated by price fluctuations.

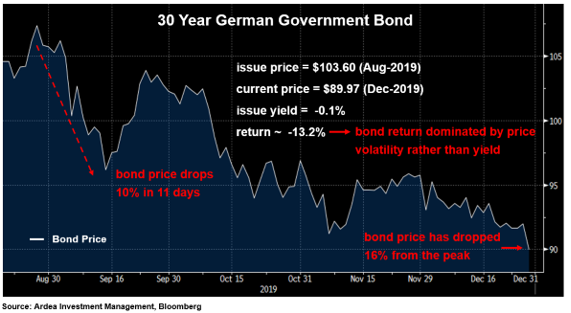

For example, the chart below shows the volatile price fluctuations of a 30-year German government bond that was issued last year. Over 2019 this bond delivered a loss of c. -13.2% because its price fell substantially. For an investor buying this bond, the expected return is dominated by price volatility and the interest income received (i.e. yield) is insignificant.

Why is this relevant to fixed income investing today?

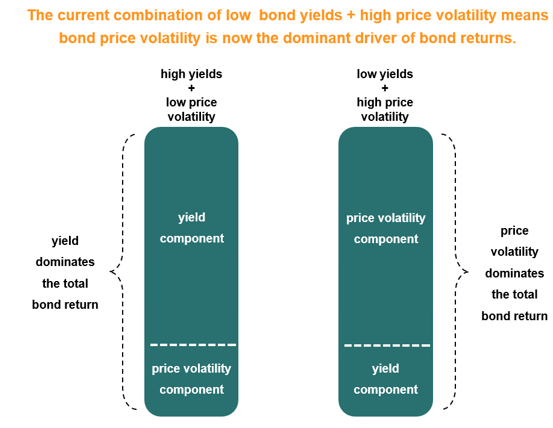

These principles are particularly relevant now because bond yields globally are very low, while bond price volatility is high. This means the price volatility component has now become the dominant driver of total returns for most conventional bond investments.

Just as these dynamics apply to individual bonds, they equally apply to conventional yield-based bond portfolios.

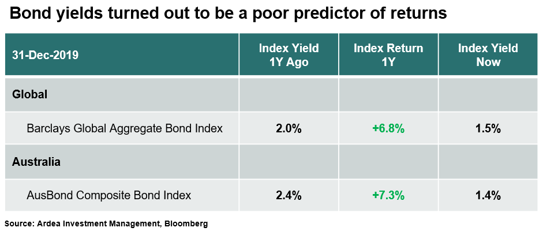

For example, the table below shows the two bond indices most widely referenced by conventional global and Australian bond funds. Each index comprises a portfolio of many bonds, whose individual yields are averaged to calculate the index yield. Similarly, price fluctuations of the index reflect price fluctuations of the underlying bonds.

The table shows that the average yield of each bond index portfolio from a year ago turned out to be a poor predictor of the actual return delivered by those portfolios over the year.

The actual return turned out to be far higher because the bull market in bonds caused bond prices to rise substantially, which meant that bond price changes ended up being the dominant driver of total returns over the year. Of course the opposite could just as easily happen i.e. bond prices could fall enough to more than wipe out all the yield earned over the year, resulting in a total return loss.

With the starting point of yields across global bond markets now at very low levels, the outlook for future bond returns is more dependent than ever on whether bond prices go up or down from here. Simply looking at a conventional bond portfolio’s current yield and assuming that will approximate the expected return is no longer good enough.

So, which way will bond prices go from here? Will the bond bull market continue pushing prices higher?

While there’s no shortage of strongly expressed opinions from the ‘expert’ market forecasters, from our experience it is very difficult (impossible?) to reliably predict market direction. Even the bond kings and macro gods struggle to get these calls consistently right. The outlook for bond markets is driven by a complex web of macroeconomic variables and feedback loops, just a few of which are discussed here and highlight just how difficult the forecasting game is.

Whichever way you think bond prices will go from here, two things are objectively clear.

Firstly, given the low starting point of yields, the only way past strong bond returns can be repeated is if bond prices keep going higher. While this is certainly possible, it’s not a given.

Secondly, when the starting point of interest rates and bond yields gets to very low levels, the risk vs. return trade-off in conventional bond investments becomes worse, not better. (details here)

So, the next time you see a fixed income investment advertising a certain yield, it’s worth considering how the price of that investment could fluctuate and what that means for the return you actually end up getting over your investment horizon.

* The caveat is for investors who actually hold all their bonds to maturity. For these investors the intermittent bond price fluctuations don’t matter, but in practice only a small minority of investors actually invest this way.

This material has been prepared by Ardea Investment Management Pty Limited (Ardea IM) (ABN 50 132 902 722, AFSL 329 828). It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Any projections are based on assumptions which we believe are reasonable, but are subject to change and should not be relied upon. Past performance is not a reliable indicator of future performance. Neither any particular rate of return nor capital invested are guaranteed.