Bonds Don’t Need to Be Negatively Correlated with Equities

It is often assumed that government bonds must be negatively correlated with equities to reduce portfolio risk. In her article published in The Journal of Investing, Dr Laura Ryan challenges this view. Her research highlights that the relative volatility of bonds to equities plays a more important role in reducing overall portfolio volatility than correlation, even if correlation is strongly positive.

Challenging the prevailing narrative

The conventional view is that bonds have lost their risk-reducing power in equity-heavy portfolios. This argument is typically based on the idea that bonds are now too often positively correlated with equities.

Dr Ryan challenges this narrative, arguing that it overlooks a key principle of portfolio construction: volatility matters more than correlation. Even if correlation becomes positive, even +100%, bonds can still reduce overall portfolio volatility, provided their volatility remains materially lower than that of equities.

Understanding diversification: more than just correlation

This research challenges the idea that negative correlation between equities and bonds (or any assets or securities) is essential for diversification. While negative correlation can enhance diversification, it is not required, portfolio volatility can still be reduced even if correlation is +1, provided the assets have different volatilities.

But before that, an important clarification: correlation measures the sign and strength of a linear relationship.

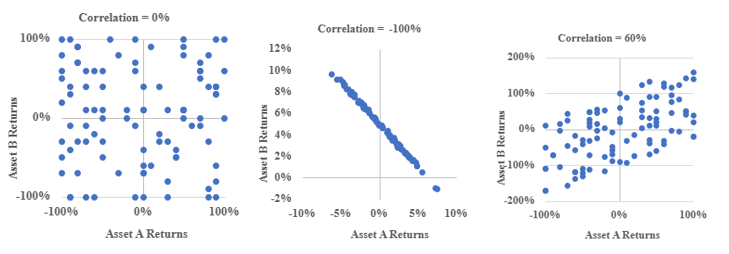

Figure 1 illustrates this with three scatterplots (asset B on the vertical axis; asset A on the horizontal):

- 0% correlation: no linear relationship, knowing one asset’s return tells you nothing about the other asset’s return.

- –100% correlation: When asset A’s returns are increasing, asset B’s returns are decreasing. This perfect negative relationship still allows both assets to have positive or negative returns at the same time

- +60% correlation: returns tend to be increasing together or decreasing together. But there are still many cases where one is positive, and the other is negative and vice versa.

These examples show that:

- Negative correlation does not mean one return is always positive when the other is negative.

- Positive correlation does not mean both returns are always positive or both always negative.

Dr Ryan then goes on to show correlation influences diversification benefits, but the dominant driver identified in this research is the relative volatility of bonds compared to equities.

Historical context and time-varying correlation

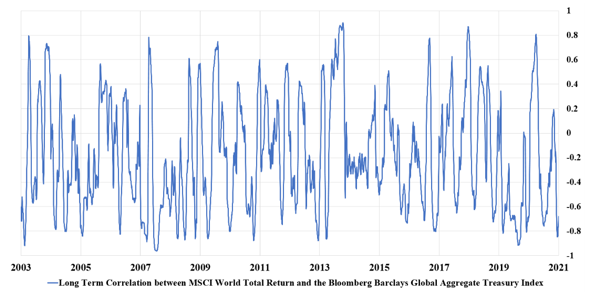

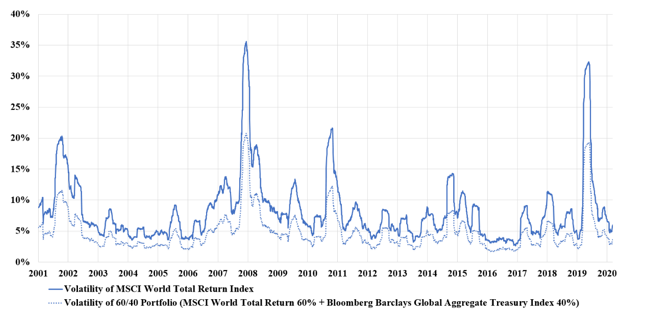

Over the past two decades, the correlation between equity and bond returns has been far from stable. Figure 2 shows that the 60-month rolling correlation has ranged from –0.9 to +0.9. Yet Figure 3 demonstrates that portfolio volatility for a 60/40 allocation has remained consistently below that of equities alone, by around 4% on average.

The consistent volatility reduction even whilst correlations are varying suggests that it is the lower volatility of bonds, not a persistent negative correlation, that has underpinned their historical risk-reduction benefits.

Scenario analysis: volatility versus correlation

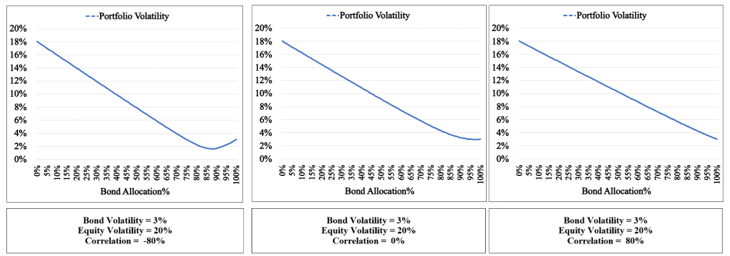

To better understand the separate effects of correlation and volatility on portfolio risk, Dr Ryan conducts two scenario tests:

1. Low bond volatility, varying correlation

Holding bond volatility at 3% and equity volatility at 20%, three scenarios are tested with correlations of –80%, 0%, and +80%. As shown in Figure 4, portfolio volatility decreases as bond allocation increases, even in the presence of positive correlation. While negative correlation improves the rate and extent of volatility reduction, the key driver remains low bond volatility.

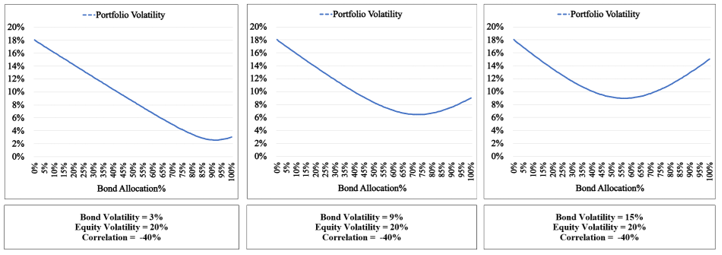

2. Fixed correlation, varying bond volatility

With correlation fixed at –40%, bond volatility is varied across 3%, 9%, and 15%. Figure 5 shows that higher bond volatility reduces the diversification benefit. Minimum portfolio volatility rises, and the bond weight required to achieve it declines.

Together, these examples demonstrate that bond volatility plays a more influential role than correlation in determining how much bonds reduce portfolio risk.

Conclusion

Dr Ryan concludes with two questions for investors to consider:

- Will bonds continue to exhibit materially lower volatility than equities?

If so, they will continue to reduce portfolio risk, even with positive correlation. - How much are investors willing to pay for reduced portfolio volatility?

This question depends on investors’ expectations for asset class returns and their own risk preferences.

Ultimately, negative correlation is not a necessary condition for bonds to reduce portfolio volatility. As long as bond volatility remains low relative to equities, bonds will continue to play a valuable role in portfolio construction.

Important Information

This material has been prepared by Ardea Investment Management Pty Limited (Ardea) (ABN 50 132 902 722). Ardea is the holder of an Australian financial services licence AFSL 329 828 and is regulated under the laws of Australia.This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe or interests and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws.This document has been prepared without taking into account any person’s objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting.This document is provided to you on the basis that it should not be relied upon for any purpose other than information and discussion. The document has not been independently verified. No reliance may be placed for any purpose on the document or its accuracy, fairness, correctness or completeness. Neither Ardea nor any of its related bodies corporates, associates and employees shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the document or otherwise in connection with the presentation.