Does fixed income still diversify portfolio risk?

Low Interest Rates and High Asset Prices – Is the Party Finally Over?

The coordinated global fall in interest rates since the 2008 financial crisis has been one of the greatest tailwinds to asset prices we have seen in modern financial history.

Interest rates underpin the valuation of all financial assets, including equities, corporate bonds, infrastructure and property, as their expected future cash flows are discounted relative to government bond yields. As such, the effect of falling discount rates has been to increase their present capital values (i.e. their prices).

This dynamic has become progressively more extreme as the accumulated effect of extraordinary central bank intervention – abnormally low interest rates, combined with asset purchases (Quantitative Easing or QE) – has pushed government bond yields to historically low (or even negative) levels and propelled investors to ever greater heights of return seeking behaviour as near zero interest rates can make any asset look attractive.

However, we are now at the point where this tailwind subsides. For the first time in years, the largest economies in the world are all growing and finally allowing central banks to look beyond monetary stimulus.

Led by the US Federal Reserve, consensus forecasts are for seven developed economies to raise interest rates in 2018. In addition, explicit guidance from the Fed and nascent murmurings from the ECB suggest net central bank asset purchases will fall to zero in 2018, a marked paradigm shift from the post-GFC environment, which was characterized by synchronised global central bank stimulus.

While the stronger global economic growth narrative is becoming more widespread, the notably missing chapter of the story so far has been inflation, which has been slow to emerge despite improving global economic growth. Not only is low inflation pervasive today, it has also become stubbornly entrenched into inflation expectations far into the future.

For this reason, markets are assuming a very gradual policy normalisation (rising interest rates and tapering of QE) that won’t disrupt financial markets – so the party is assumed to continue.

However, given this policy normalisation is occurring after an unprecedented period of market distorting stimulus, it is far from clear what the unintended consequences will be for financial markets and their underlying economies.

What is clear though, is that even a little too much inflation can easily upset this delicate balance.

Whilst inflation in most countries remains below target levels, there are early indications that inflationary pressures are building. Notably, labour markets globally are tightening, manufacturing costs are rising and even in the land of deflation, the Bank of Japan recently noted that inflation expectations have stopped falling.

For years central banks have walked an increasingly fine line by prolonging stimulatory policies without any real visibility on how well the transmission mechanism to inflation is working and thus any control over how much inflation eventually arrives. So, the risk of an overshoot is real.

History shows that when inflation expectations shift, they shift quickly and like the proverbial farmer praying for a rain but getting a crop destroying flood, too much inflation would be an undesirable outcome that forces more aggressive policy normalisation than markets are anticipating. In this scenario the party would be over.

What does this mean for my investments?

In this situation, assets that shone brightly against the dim light of a low interest rate world would be reassessed under the harsh glare of higher discount rates, likely repricing everything from equities to real estate. Against this backdrop, it’s natural to question whether government bond holdings can still play their traditional role as risk diversifiers.

Let’s begin with the traditional context, where a conventional ‘risk-off’ scenario like a recession occurs. Investors can probably expect their government bond holdings to help offset equity losses as capital flees to safety and bond prices rise as interest rates are cut. The conventionally assumed negative correlation between bond and equity prices holds and portfolio risk diversification works as expected.

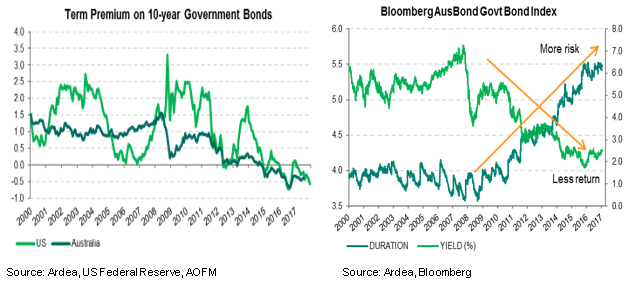

Alternatively, if the current consensus view – improving economic growth, contained inflation and gradual central bank policy normalisation – does indeed play out, bonds provide stable income (yield) but still expose investors to risk of modest capital losses from rising interest rates (duration risk). The longer the tenor of the bond, the greater the duration risk – and the compensation for bearing this risk can be valued by the term premium.

The current combination of very low yields and term premia, means bond holders are being poorly compensated for bearing duration risk. This implies that the implicit cost of owning bonds as a form of risk diversification, even if it works, is currently very high. The issue is compounded for passive bond investments as benchmark index duration has extended (more risk), while average yields have declined (less return) and there is asymmetric risk of capital losses from rising interest rates.

So, even in the scenarios where bonds perform as intended, the defensiveness of conventional bond strategies has been compromised, making it very expensive to hold them for risk diversification.

Meanwhile, the underestimated scenario – nascent inflationary pressures become more established – would quickly shift focus to fear of inflation overshooting, forcing aggressive, unexpected and disruptive normalisation of monetary policy. Bonds then become the catalyst for a broader sell-off in other asset classes, rather than acting as a defensive risk diversifier.

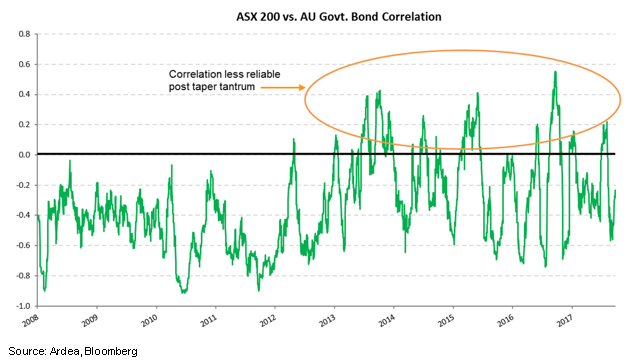

We got a small taste of what such unanticipated policy tightening can do to markets during the ‘taper tantrum’ in 2013. At that time Ben Bernanke unexpectedly announced the possibility of reducing the US Federal Reserve’s bond buying program, causing bond prices to drop sharply and triggering a sell-off in equities.

The chart below shows how the Australian bond-equity correlation behaved before and after this event. Prior to 2013 there was a generally reliable negative bond-equity correlation, which is desirable for risk diversification. However, since then the relationship has become less reliable.

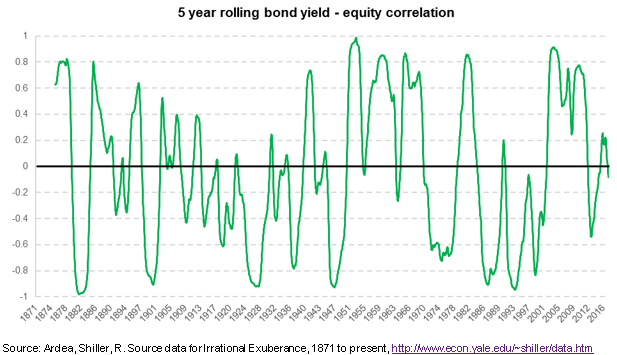

In fact, this marked change is not unique to Australia or to recent history. Long term US data shows that bond-equity correlations are unstable, tending to be impacted by inflation and interest rate paradigm shifts.

While such paradigm shifts are easier to identify in hindsight than to recognise in real time, there are enough early indicators suggesting we are in the initial stages of one. But irrespective of whether this scenario plays out, the conclusion remains the same – the assumed negative correlation between bonds and equities is not as reliable as hoped for.

The implication for portfolio construction is clear. Re-evaluate the conventional assumption that owning government bonds is inherently defensive and risk diversifying. At best, it’s an expensive choice and at worst, it won’t work.

There’s more to fixed income than just buying and holding bonds. It‘s an asset class with a wide range of instruments, strategies and return sources that can be exploited to achieve genuine risk diversification. For example, the same factors that distorted bond market valuations have also created relative value pricing anomalies, underpriced volatility, skewed risk premia and cheap tail risk opportunities that can all be used for effective risk diversification in a truly defensive fixed income portfolio.

So yes, fixed income can still diversify portfolio risk but only if you choose the right strategy.