Markets wake up to China risk

We’ve been noticing early warning indicators of China risk flaring up and those risks have now become real.

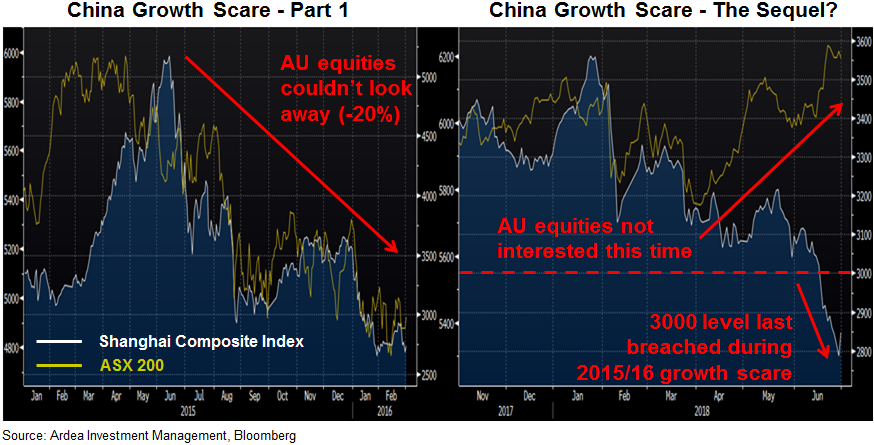

China’s equity market dropped 8% this month and broke the key 3000 level, while the currency was down 4%. Both moves are reminiscent of the 2015/16 China growth scare that saw the ASX 200 drop 20% peak to trough.

This time around commodity prices and the Australian dollar have declined, as to be expected given the links to China’s economy, but domestic equity and bond markets have yet to react (at the time of writing).

Which is all the more surprising given the resources sector accounted for more than 50% of the ASX 200’s total return for FY18.

China’s central bank, the People’s Bank of China (PBOC), has better insight into the real state of China’s economy than anyone else. So when they send a message it’s worth listening and their recent liquidity injections, their softening stance on deleveraging and increased focus on stabilising market expectations sends a clear message that they are taking recent market and economic weakness seriously.

The difficulty in positioning for these types of risks is that you can’t predict a) timing or b) China’s policy response. Which makes more conventional ‘hedging’ approaches like buying equity put options challenging, because they can be expensive to hold and need to be timed correctly.

In these situations positions that have positive asymmetry (meaning the downside is disproportionately small relative to the upside) and don’t have a finite time horizon are useful because they don’t need to be timed perfectly, cost little to hold and the downside is small if the risk being hedged doesn’t play out.

One such opportunity currently exists in the Australian overnight index swap (OIS) market, as described in the previous section.

Currently, the OIS curve assigns zero probability to the scenario of the RBA cutting rates, which makes sense given the RBA is still optimistic on the growth outlook and has been signalling that the next rate move is more likely to be up than down.

However, viewing this is as a risk hedge rather than as a bet on what the RBA is actually going to do, is what creates the asymmetric opportunity.

Because the consensus is so heavily skewed towards future rate hikes, it’s very cheap to take the opposite position as a risk hedge, irrespective of whether that’s the base case or not.

In the event of a major slowdown in China’s economy, it’s very likely the market consensus will reverse and start pricing at least some probability of rate cuts, making these positions profitable.

Add to this the growing risks around a trade war and also the slowing domestic housing market, both of which could put RBA rate cuts into play, OIS positions are a very cheap form of insurance and an effective hedge for Australian equities.

This is not the kind of opportunity that most equity investors focus on, or are even aware of … but it’s a great one nonetheless.

Ardea Investment Management