Mrs. Watanabe meets European insurance companies

Since the early 2000’s the name ‘Mrs. Watanabe’ has been used to describe yield seeking Japanese retail investors, who were forced to increase their offshore investment risk taking in response to ultra-low interest rates back home.

The choice of name reflected that many of these investors were in fact Japanese housewives.

Their risk taking behaviour is often crticised as an undesirable consequence of the extreme monetary policy stimulus that central banks are undertaking. They are also well known because they are large enough as a group to move global financial markets.

A European institutional equivalent of Mrs. Watanabe is the European insurance companies. As more and more EU interest rates collapse into negative territory, European insurers are becoming increasingly desperate to generate higher yields on their investment portfolios.

This year Mrs. Watanabe found herself shopping for yield in the same market as the European insurers – the French government bond market – and the result was a fantastic ‘relative value’ (RV) opportunity.

Due to a combination of relatively high yields and favourable pricing in currency markets, long dated French government bonds were in a sweet spot for Japanese investors to buy them in Euros, hedge the currency risk and end up with a higher yielding JPY equivalent bond.

Mrs. Watanabe jumped at the opportunity, resulting in large capital flows flooding into French government bonds and pushing up their prices. For example, balance of payments data published by the Bank of Japan showed Japanese investors purchased a record EUR26bn worth of French government bonds in March alone.

One way for a fixed income fund to profit from this would be to simply buy the same French bonds and bet that Japanese demand will keep pushing their prices up. This would be a simple and conventional way to do it but also comes with a lot of market directional risk (e.g. duration risk).

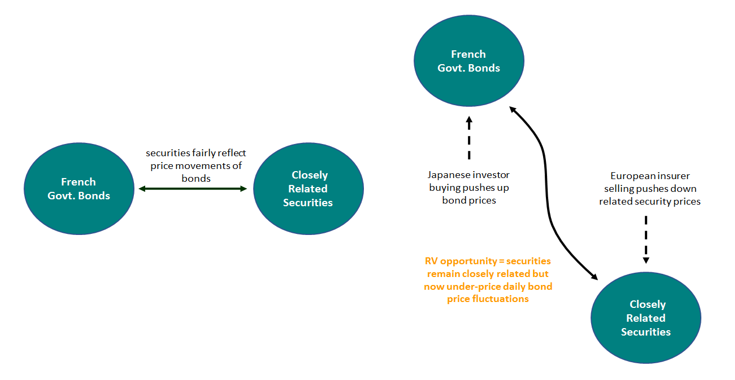

By contrast, a pure RV approach seeks to profit from the opportunity in a way that strips out unwanted directional market risk by precisely isolating pricing inconsistencies between closely related securities.

This is where the European insurers enter the picture.

At the same time that Mrs. Watanabe was on a French bond shopping spree, European insurers were selling options on those same bonds. They did this to earn option premiums (i.e. upfront payments to option sellers), to help boost the returns on their investment portfolios.

The RV opportunity arose because the French bonds, the bond options and a few other securities are all very closely related to each other and their prices ultimately reflect the same risk (i.e. price fluctuations of the bonds). However, they didn’t all price the risk consistently because of market segmentation (i.e. different market participants buying and selling for different reasons).

In this case, the heavy selling of options by the insurers caused them to under-price the daily price fluctuations of the bonds they’re closely related to. At the same time, the heavy buying of bonds by Japanese investors caused the actual daily price movements of those bonds to increase.

In option terminology, this was an unusual case where option ‘implied volatility’ dropped lower than ‘realised volatility’. (we covered this here)

The RV investor buys the cheap options, takes an offsetting position in the more expensive bonds and profits from capturing the inconsistency in pricing between the two. Meanwhile, the net package has zero interest rate duration, no exposure to general market fluctuations and profits irrespective of whether the bond price goes up or down, as long as the bond price moves.

An added bonus is that this position is ‘long volatility’ and ‘long convexity’, which means the more volatile markets get, the more profitable the position becomes. (explained here)

The risk in this type of strategy is very low because the downside is limited and known with certainty.

These types of opportunities don’t rely on correctly predicting the direction of rates, the path of economic growth or what central banks will do. They come from understanding the structural drivers of market inefficiency such as regulation and investor mandate constraints, and how they drive the interactions between buyers and sellers, who are responding to different incentives.

A useful analogy is that of large ships turning in the ocean. A conventional investing approach, based on trying to predict market direction, needs to correctly guess in advance which way the ships are going to turn. An RV approach waits for the ships to turn and profits from the inevitable mispricing resulting from all the ripples they create.

As interest rates around the world keep going lower, they’re influencing investor behaviour in more extreme ways (i.e. the ships are swinging around more often and more violently). This in turn creates more RV opportunities for those who have the right tools and experience to exploit them in a risk controlled way.

These types of RV strategies blend well with conventional investments because they do best in volatile markets, when conventional investments can incur losses.