New Zealand Inflation Indexed Bonds

Newly Issued New Zealand 2035 Inflation Indexed Bond

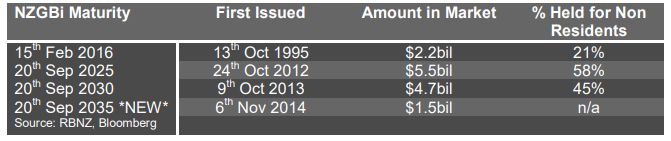

The New Zealand Debt Management office issued NZD $1.5billion of a new inflation linked bond with a real yield of 2.74% and a maturity of 20th September 2035. This represents a significant extension of the yield curve from the previous long-dated linker, maturing in 2030, and now provides a sovereign real yield curve extending out beyond the 20-year tenor.

The issuance is consistent with the NZDMO’s government’s objective to lengthen the maturity of its debt profile, and to broaden its investor base and thus reduce the frequency which existing debt must be rolled. This move is steadily transforming the New Zealand government bond market to a structure more similar to that observed in most offshore markets, with a variety of issues available across a broad maturity spectrum. This change is a positive one from a market depth and liquidity perspective.

Liquidity has improved considerably

The liquidity of the New Zealand inflation linked bond market has improved considerably since 2012 as new issuance has been undertaken and new investors are starting to get involved, including a growing number of offshore investors. For instance, while $1.5billion of the new 2035 maturity bond was issued there was demand by investors for more than $2billion. This overhang of demand helps the bond’s liquidity and creates good price tension as soon as the bond is issued.

The introduction of the new 2035 bond will increase the size of the New Zealand physical inflation linked bond market to nearly NZD $14 billion (market value). This new issue also helps with the NZDMO’s target of issuing up to 20% of all debt through inflation linked bonds.

The NZDMO now has 4 inflation indexed bonds on issue comprising 18% of total government bond issuance.

Attractive Pricing

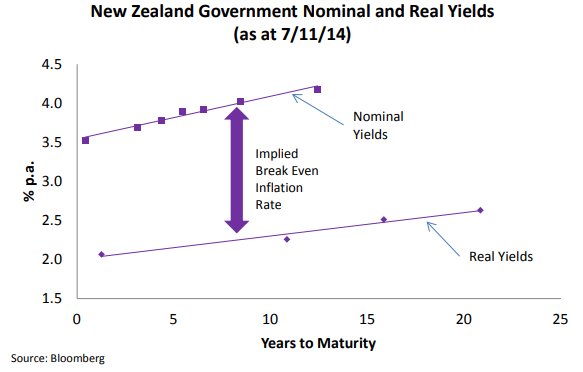

How do we determine whether inflation linked bonds offer value to the investor? Inflation indexed bonds are like nominal bonds but, as their name implies, their returns are linked to actual inflation whereas nominal bond yields incorporate the market’s assumption about expected inflation. The real yield of equivalent maturity real and nominal bonds is therefore the same. This means that the market’s current expectation for inflation is important and will affect the relative value of a nominal versus inflation linked bonds. This expectation for inflation is called “breakeven inflation” and is the market’s assumption of the level of inflation that has to eventuate that would make an investor indifferent to holding nominal bonds over inflation linked bonds.

The appropriate framework to consider whether to invest in inflation indexed securities is therefore twofold.

First, decide how much of an allocation the investor wants to real yields at a given level of duration. This will determine how much exposure the investor will have to bonds generally, either nominal or inflation linked, in their portfolio. The real yield now at 2.55% at the long end of the curve is the highest of any developed market for a similar maturity and as such remains attractive for both domestic and offshore investors.

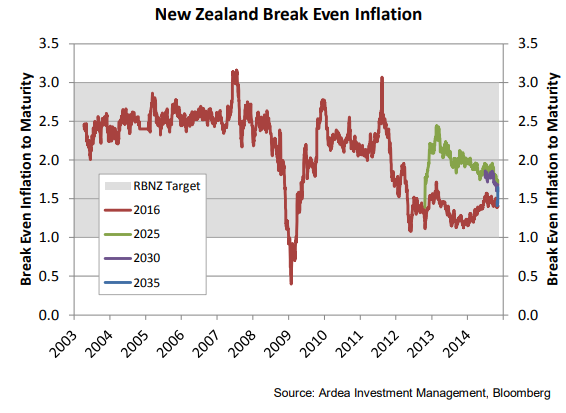

Secondly, to determine how much of that real yield duration is sourced from nominal or inflation indexed bonds, decide how much exposure the investor wants to inflation given the current market implied, break even inflation rate. This answer then has to be overlayed with the investors unique risk tolerance for, and current exposure to, unexpected inflation outcomes. At present inflation in New Zealand and globally is subdued and as such breakeven inflation is quite low, but there is the belief that based on current economic factors, such as net migration, low unemployment and an eventual global recovery, inflation in New Zealand could rise.

The breakeven inflation on this new bond is 1.64% p.a which means it is possible to lock in inflation at that rate for the next 21 years. In our view this is a fairly attractive level considering the uncertainty in regards to economic fundamentals, the RBNZ’s inflation target range of between 13% p.a. and the potential path for materially higher inflation. For a New Zealand investor, we think it makes sense to be overweight inflation indexed bonds relative to nominal bonds at this juncture.

Strategy

When new maturities are issued for the first time there is normally a premium given to investors and this bond was no different. As we believe that this creates a good opportunity for investors, along with the attractive real yield and low breakeven inflation level, we participated in buying this new bond for our portfolios. The improving liquidity of the market also creates the possibility to easily switch into other lines in future once the premium on new issuance has been fully realised.

If you would like to understand more about our investment strategy in the New Zealand bond market please contact us.

Ardea Investment Management