Sustainability Related Disclosures

a) Summary

The Ardea Global Alpha Fund (the ‘Fund’) promotes environmental characteristics but does not have as its objective sustainable investment.

The Fund operates a specialised ‘relative value’ investment approach with respect to high quality government bonds. Relative value mispricing is caused by market inefficiencies and occurs when comparable securities that have similar risk characteristics are priced differently. Amongst the risk factors considered by the Investment manager is environmental risk, including climate risks, both physical and transition.

The Investment Manager promotes environmental characteristics and integrates ESG factors (including the consideration of Sustainability Risks) into the investment strategy and decision-making process described under the heading “Investment Strategy” below in the following ways:

(a) the application of the following positive screens, namely:

- a relative value assessment of Green Bonds over Brown Bonds that preference Green Bonds over Brown Bonds;

- increasing the Fund’s minimum per annum turnover in Green Bonds each calendar year as a percentage of the Net Asset Value of the Fund (as detailed further below); and

(b) integration of Sustainability Risks, including, through the performance of climate change scenario modelling (as detailed further below).

Green Bond Relative Value Assessment: The Investment Manager positively screens bonds with the Investment Manager selecting Green Bonds in preference to comparable Brown Bonds where the relative value is the same. Green Bonds are fund projects that have positive environmental and/or climate benefits. Proceeds from these bonds are earmarked for green projects but are backed by the issuer’s entire balance sheet. Brown bonds are bonds that are not Green Bonds.

Green Bond Turnover: In addition to the positive screen applied to Green Bonds, the Investment Manager also integrates Green Bond market allocations by targeting increased levels of annual turnover in the Green Bonds as a percentage of the Net Asset Value.

Integration of Sustainability Risks: The Investment Manager evaluates and integrates Sustainability Risks and other relevant ESG factors (such as carbon intensity, energy transition, and physical climate change risks) at multiple stages throughout the investment process. This is considered an important element in contributing towards long-term investment returns and an effective risk-mitigation technique.

For non-English translations of this summary please click here.

b) No sustainable investment objective

The Fund promotes environmental or social characteristics but does not have as its objective sustainable investment. While it does not have sustainable investment as its objective, it will have a minimum proportion of 5% of sustainable investments with an environmental objective in economic activities that do not qualify as environmentally sustainable under the EU Taxonomy. This represents the minimum proportion of the Fund that will be invested in Green Bonds.

Notwithstanding that the Investment Manager integrates the consideration of Sustainability Risks into the investment decision-making process, the Investment Manager does not currently consider the principal adverse impacts of its investment decisions on Sustainability Factors. The Investment Manager has opted against doing so, primarily as the market for Green Bonds is underdeveloped, there is a lack of sufficiently detailed data regarding the Fund’s investment universe that will allow the Investment Manager to make the relevant assessments and there is a lack of common criteria and practices for defining the necessary indicators that are relevant to the Fund’s investment strategy.

For the purpose of the Taxonomy Regulation, the Fund does not presently intend to be invested in investments that take into account the EU criteria for environmental sustainable economic activities. Therefore, 0% of the Fund’s investments will be invested in economic activities that qualify as environmentally sustainable under the Taxonomy Regulation. This is for the reasons stated above with respect to the market for Green Bonds.

The “do no significant harm” principle applies only to those investments underlying the Fund that take into account the EU criteria for environmentally sustainable economic activities. The investments underlying the remaining portion of the Fund do not take into account the EU criteria for environmentally sustainable economic activities.

The Fund does not have exposure to Sustainable Investments that, in the reasonable opinion of the Investment Manager, (which opinion may be based on external analysis) have violated the minimum standards of practice represented by widely accepted global conventions including, but not limited to, the OECD Guidelines for Multinational Enterprises, the UN Guiding Principles on Business and Human Rights, the ILO Declaration on Fundamental Principles and Rights at Work, and the UNGCP. The alignment of Sustainable Investments with such conventions forms part of the Investment Manager’s ‘do no significant harm’ investment process/criteria.

Organisations such as the Climate Bonds Initiative (CBI) and the International Capital Market Association (ICMA) verify the green bonds to ensure quality and the positive environmental benefits. This process mitigates the risk of the investment causing significant harm to environmental objectives. However, there is currently no means of assessing whether the green bonds do not cause significant harm to any environmental or social sustainable investment objective.

c) Environmental or Social (“E/S”) characteristics of the financial product

The Fund promotes a range of environmental characteristics through some of the direct and indirect investments it makes, namely the development of the “Green Bond” market issued by high grade governments, either by directly acquiring such bonds or investing in them through derivatives. The Investment Manager also promotes the development of the Green Bond market through the publication and promotion of academic research and investigating the role of derivatives in the promotion or otherwise of environmental characteristics. This research informs the climate change stress testing the Fund applies to its strategies.

A reference benchmark has not been designated for the purposes of attaining the environmental characteristics promoted by the Fund.

The Investment Manager promotes environmental characteristics and integrates ESG factors (including the consideration of Sustainability Risks) into the investment strategy and decision-making process described under the heading “Investment Strategy” above in the following ways:

(a) the application of the following positive screens, namely:

- a relative value assessment of Green Bonds over Brown Bonds (as detailed further below);

- increasing the Fund’s minimum per annum turnover in Green Bonds each calendar year as a percentage of the Net Asset Value of the Fund (as detailed further below); and

(b) integration of Sustainability Risks, including, through the performance of climate change scenario modelling (as detailed further below).

Green Bond Relative Value Assessment: The Investment Manager positively screens bonds with the Investment Manager selecting Green Bonds in preference to comparable Brown Bonds where the relative value opportunity is the same. This is undertaken during the “Identify” phase of the investment process and on an ongoing basis. Guidelines on how Green Bonds are to be assessed are provided by organisations such as the Climate Bonds Initiative (CBI)[1] and the International Capital Market Association (ICMA). Each organisation specifies that alignment with the Green Bond criteria is to be assessed by qualified, accredited verifiers.

Green Bond Turnover: In addition to the positive screen applied to Green Bonds, the Investment Manager also integrates Green Bond market allocations by targeting increased levels of annual turnover in the Green Bonds as a percentage of the Net Asset Value.

Integration of Sustainability Risks: The Investment Manager evaluates and integrates Sustainability Risks and other relevant ESG factors (such as carbon intensity, energy transition, and physical climate change risks) at multiple stages throughout the investment process. This is considered an important element in contributing towards long-term investment returns and an effective risk-mitigation technique. The Investment Manager believes its ESG-related research capabilities enable the identification of ESG risks and opportunities of most relevance to the strategy. Specifically, the strategy generates returns via the implementation of the RV strategy outlined above which isolates mispricing between securities and mitigates exposure to market risks, including, Sustainability Risks and ESG risk factors.

The following factors will be considered in determining whether the Fund is attaining the environmental characteristics it promotes:

- (i) Positive Screen: the first factor contributing to whether the Fund will be considered to be attaining the environmental and/or social characteristics it promotes will be an assessment of whether the Fund has successfully and consistently applied its positive screen in the relative value assessment of green bonds over brown bonds which results in selecting green bonds in preference to comparable brown bonds where the relative value is the same;

- (ii) Increase in turnover of green bonds: the second factor contributing to whether the Fund will be considered to be attaining the environmental and/or social characteristics it promotes will be an assessement of whether the Fund has successfully and consistently increased the Fund’s minimum per annum turnover in green bonds each calendar year as a percentage of the Net Asset Value of the Fund; and

- (iii) Integration of sustainability risks: the third factor contributing to whether the Fund will be considered to be attaining the environmental and/or social characteristics it promotes will be through the performance of climate change scenario modelling of the investment universe. This modelling is informed by the Fund’s proprietary research on climate risks and government bond markets and is performed regularly (forming part of the “Exploit” stage of the investment process) and reported alongside other market shocks. This enables the Fund to account for Sustainability Risks through the climate change scenario modelling.

d) Investment strategy

The Fund’s investment strategy is a relative value (“RV”) strategy focused on fixed income by investing in high quality government bonds as set out in Sections 3.2 and 3.3 of the Fund’s supplement. The Investment Manager’s pure RV investment approach delivers returns with low correlation to the broader markets and independent of general market fluctuations. Relative value mispricing is caused by market inefficiencies and occurs when comparable securities that have similar risk characteristics are priced differently. Fixed income market inefficiency has proven to be persistent over time and across market cycles because its underlying drivers are structural in nature. The activity of “non-economic” market participants, such as banks conducting asset-liability management, governments financing budgets, or central banks pursuing policy objectives, may create disparate buying and selling flows that affect closely related securities. Such temporary demand-supply imbalances lead to fixed income market inefficiency, therefore, creating RV mispricing trading opportunities. Amongst the risk factors considered by the Investment manager is environmental risk. This is the means by which the Investment Manager promotes environmental and social characteristics.

The Fund invests in government bonds including Green Bonds and monitors the policy outlook and initiatives of investee governments in assessing whether the Fund’s investments are continuing to follow good governance. Engagement with government issuers is the main avenue by which the Fund initiates improvement and corrective action as required.

The Investment Manager also engages with:

- Its clients to understand what their expectations are;

- The media to help increase information provided to the market on sustainability matters;

- Research houses to understand risks and opportunities and to highlight the need for targeted research on sovereign bond sustainability matters;

- Academia so that the Investment Manager can highlight the need for additional research on sustainability outside of equities, corporate debt and property;

- Other key participants within financial markets such as clearing houses and exchanges, which have the potential to perform new and innovative functions with respect to sustainability;

- Policy makers and regulators, whose interests are often aligned with sustainability-aware investors due to taking a longer-term focus than private financial market participants; and

- Investment bank capital market desks and dealer panels, who through their market-making role can advise sovereigns on sustainability issues that might be material to pricing and would increase the attractiveness of their bonds.

e) Proportion of investments used to meet E/S characteristics

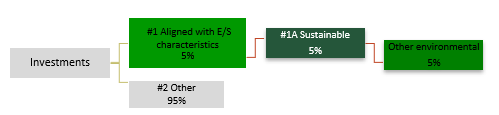

#1 Aligned with E/S characteristics includes the investments of the financial product used to attain the environmental or social characteristics promoted by the financial product.

#2 Other includes the remaining investments of the financial product which are neither aligned with the environmental or social characteristics, nor are qualified as sustainable investments. The Fund seeks to maintain the entirety of its investments within the government fixed income universe. The Fund may hold minimal holdings of liquid and near-cash assets where these are necessary to achieve the Fund’s investment allocation, or necessary for day-to-day operations of the Fund. Interest rate swaps, futures, and other derivatives that generate an economic exposure in line with that of government fixed income are grouped alongside their physical equivalents under other sustainable investments, while any resulting cash or other collateral assets are grouped under other.

The category #1 Aligned with E/S characteristics covers:

- The sub-category #1A Sustainable covers sustainable investments with environmental or social objectives.

See paragraph (b) above for a description of each of the Fund is applied by the Fund.

f) Monitoring of E/S characteristics

The following factors will be considered in determining whether the Fund is attaining the environmental characteristics it promotes:

- (i) Positive Screen: the first factor contributing to whether the Fund will be considered to be attaining the environmental and/or social characteristics it promotes will be an assessment of whether the Fund has successfully and consistently applied its positive screen in the relative value assessment of green bonds over brown bonds which results in selecting green bonds in preference to comparable brown bonds where the relative value opportunity is the same;

- (ii) Increase in turnover of green bonds: the second factor contributing to whether the Fund will be considered to be attaining the environmental and/or social characteristics it promotes will be an assessment of whether the Fund has successfully and consistently increased the Fund’s minimum per annum turnover in green bonds each calendar year as a percentage of the Net Asset Value of the Fund; and

- (iii) Integration of sustainability risks: the third factor contributing to whether the Fund will be considered to be attaining the environmental and/or social characteristics it promotes will be through the performance of climate change scenario modelling of the investment universe.

The binding elements of the investment strategy used to select investments to attain each of the environmental and social characteristics promoted by the Fund are:

- (i) Positive Screen: in the relative value assessment of green bonds over brown bonds which results in the selection green bonds in preference to comparable brown bonds where the relative value is the same. In assessing green bonds, the Investment Manager has regard to the guidelines provided by the Climate Bonds Initiative and the International Capital Market Association.

- (ii) Increase in allocation to green bonds: the Investment Manager integrates green bond market allocations by targeting increased levels of annual turnover in green bonds as a percentage of the Net Asset Value.

- (iii) Integration of sustainability risks: the Investment Manager evaluates and integrates Sustainability Risks and other relevant ESG factors (such as carbon intensity, energy transition and physical climate change risks) at multiple stages throughout the investment process. Specifically, the strategy generates returns via the implementation of the RV strategy outlined above which isolates mispricing between securities and mitigates exposure to market risks, including, Sustainability Risks and ESG risk factors.

g) Methodologies

The following factors will be considered in determining whether the Fund is attaining the environmental characteristics it promotes:

- (i) Positive Screen: the first factor contributing to whether the Fund will be considered to be attaining the environmental and/or social characteristics it promotes will be an assessment of whether the Fund has successfully and consistently applied its positive screen in the relative value assessment of green bonds over brown bonds which results in selecting green bonds in preference to comparable brown bonds where the relative value is the same;

- (ii) Increase in turnover of green bonds: the second factor contributing to whether the Fund will be considered to be attaining the environmental and/or social characteristics it promotes will be an assessement of whether the Fund has successfully and consistently increased the Fund’s minimum per annum turnover in green bonds each calendar year as a percentage of the Net Asset Value of the Fund; and

- (iii) Integration of sustainability risks: the third factor contributing to whether the Fund will be considered to be attaining the environmental and/or social characteristics it promotes will be through the performance of climate change scenario modelling of the investment universe.

h) Data sources and processing

The Fund uses the proprietary internal research data and third-party data. The primary data sources are spread across three key areas:

- Internal research to identify the sensitivity of government bond yields to key climate change metrics. This research provides a foundational framework for assessing the broad climate-related risks accruing to the government fixed income sector as a whole.

- Scenario analysis and stress testing investment portfolios according to IPCC climate change scenarios and associated changes in government bond yields across the forward horizon.

- Carbon intensity and emissions reporting consistent with regulatory requirements and standards. These measurements provide a standardised means of reflecting climate change exposures that is intended to be universal across different sectors and thus allows investors to perform aggregate portfolio analysis to determine their overall exposure to climate related risks, including all assets held.

The main variation in using data for a government bond portfolio is the use of country-level GDP in place of corporate issuer revenue, and country sovereign bond market capitalisation in place of corporate issuer market capitalisation. Some figures are also scaled by GDP in US dollars to allow for comparability and aggregation at the total portfolio level. Emissions data are sourced from EDGAR, as availability of scope 1 and 2 emissions at the country level remains unclear.

Figures for portfolio data are for the stated reporting period whereas other data including emissions, GDP, and market capitalisation, are most recent available which in some cases will be for an earlier period.

i) Limitations to methodologies and data

Sovereign government bonds pose some unique differences with other asset classes, such as the absence of equity market capitalisation and no direct parallel to private sector measures such as revenue or profit, several adjustments have been made to calculate appropriate carbon intensity and emissions exposures across portfolios.

Data for other environmental and social factors such as water use, biodiversity impacts and waste recycling are not yet reported on by most Governments. Data constraint is one of the biggest challenges when it comes to providing sustainability related information to end-investors, especially in the case of principal adverse impacts of investment decisions. There are also limitations on sustainability and ESG-related data provided by market participants on comparability. These disclosures may develop and be subject to change due to ongoing improvements in the data provided to, and obtained from, Governments to achieve the objectives of SFDR in order to make sustainability-related information available.

j) Due diligence

The Investment Manager evaluates and integrates Sustainability Risks and other relevant ESG factors (such as carbon intensity, energy transition, and physical climate change risks) at multiple stages throughout the investment process. This is considered an important element in contributing towards long-term investment returns and an effective risk-mitigation technique. The Investment Manager believes its ESG-related research capabilities enable the identification of ESG risks and opportunities of most relevance to the strategy. Specifically, the strategy generates returns via the implementation of the RV strategy outlined above which isolates mispricing between securities and mitigates exposure to market risks, including, Sustainability Risks and ESG risk factors.

To identify the potential stressors to the strategy, each of the Investment Manager’s portfolios are stressed regularly according to forward looking macroeconomic and macro agnostic scenarios. The portfolios include ‘risk-off’ strategies (optionality), which are explicitly designed to profit during periods of market stress and so are designed to provide protection against market volatility and downside tail risks. Market stress caused by Sustainability Risks and ESG outcomes are included in this category.

When making investment decisions and assessing Sustainability Risks, the Investment Manager will use a combination of internal and/or external ESG research to evaluate an investment. The Investment Manager’s internal research team focuses on the publication and promotion of academically published research which measures the climate transition risks that the global government bond markets are exposed to, and stressing strategies for climate risks. The Investment Manager also utilises external research with global norms and conventions, including the UN Global Compact, the OECD Guidelines for Multinational Enterprises, ILO Tripartite Declaration of Principles, UN Draft Human Rights Norms for Business, UN Guiding Principles on Business and Human Rights, and other sector specific standards. The Investment Manager also partners with academic institutions to conduct research on Sustainability Risks and ESG risks and opportunities in the government bond market.

The Investment Manager undertakes climate change scenario modelling on the portfolio based on climate scenarios endorsed by the IPCC across various time zones. This modelling is informed by the Fund’s proprietary research on climate risks and government bond markets and is performed regularly (forming part of the “Exploit” stage of the investment process) and reported alongside other market shocks. This enables the Fund to account for Sustainability Risks through the climate change scenario modelling.

k) Engagement policies

The Investment Manager’s formalised engagement policy seeks to engage with a range of industry participants all with the goal of boosting the narrative around ESG, especially environmental characteristics and climate change, and therefore influencing change.

Some examples of recent engagements of particular relevance to the green bond market include:

- The Investment Manager’s staff presenting at conferences and participating in discussion panels to support industry development and interest in the green bond market, and share client expectations.

- Attending issuer briefings and offsites focused on specific ESG components, most recently social and community housing bond issuance.

- Ongoing liaison and discussion with core issuers such as the sovereign and the states in Australia, including conveying client concerns and expectations, encouraging further disclosures, and indicating demand for new forms of issuance including green bonds as they eventuate.

Engagement with Academic Institutions highlights the need for additional research on ESG outside of equities, corporate debt and property. We have a formalized research partnership with the University of Technology Sydney with the express goal of understanding how climate risks impact government rates markets. Link. We are also a regular (every semester) guest lecturer at the UTS as part of their sustainable finance course. Our goal is to raise awareness of the importance of sustainability risks when it comes to investing in government bonds. Most university course syllabus globally focusses on Equities and Corporate bonds.

l) Designated reference benchmark

A reference benchmark has not been designated for the purposes of attaining the environmental characteristics promoted by the Fund.

[1] https://www.climatebonds.net/certification