Solvency II and Derivatives – Part 4

Part 4: Ardea’s strategy and the impact of derivative classification

The final paper in this short series on how Solvency II (SII) applies to the use of derivatives within a pure relative value (RV) investment strategy. Here, we examine the impact of derivative classification and show how these rules translate into capital outcomes. The first paper set out the core principles of SII as they relate to derivatives in an RV context. The second explored the Prudent Person Principle and the role of Efficient Portfolio Management (EPM), while the third focused on risk mitigation and the treatment of different hedge types. This final part brings those threads together with practical examples of how classifications affect Solvency Capital Requirement calculations.

Impact of different derivative classification

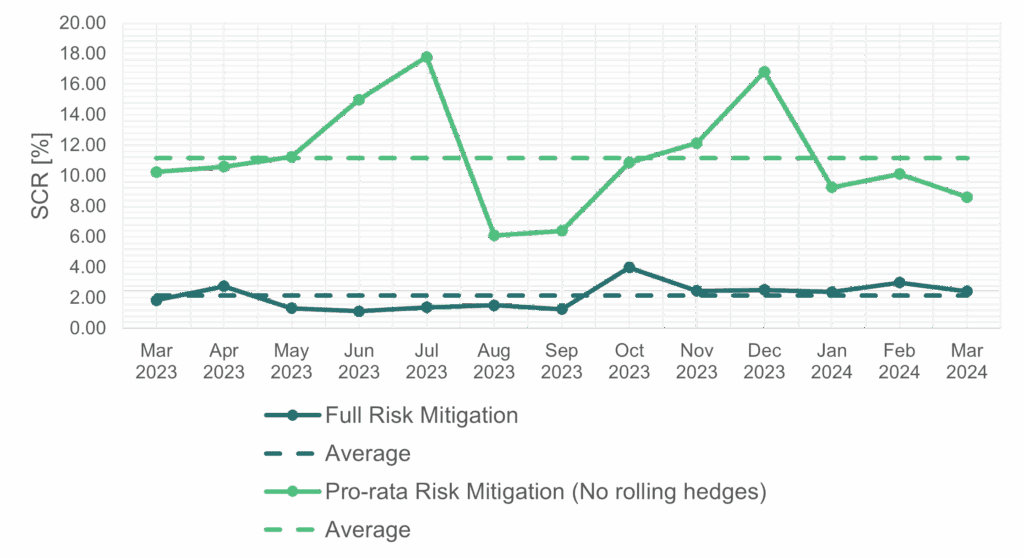

In the previous paper, we examined different types of risk-mitigating techniques in theory. In this paper, we turn to the practical impact of derivative classification when applied to a pure relative value strategy. Figure 1 below shows the comparison of possible capital charges on a pure RV strategy. The blue curve is when all derivatives fall under the ‘other hedges – non rolling’ classification. Here, all the short-dated derivatives have their hedging impact reduced on a pro rata basis. Note the significant variation in charge from as low as 6% to as high as 23%.

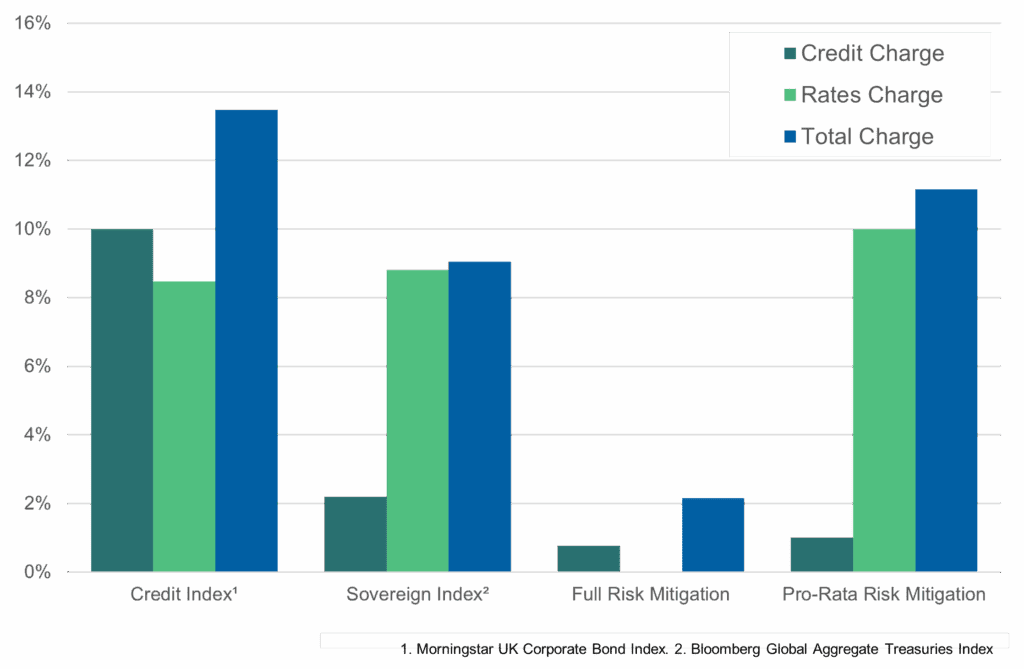

This is counter intuitive to an RV strategy and solely depends on where the snapshot is taken as to when we have rolled our derivatives. The pro-rata risk mitigation average sits at around 11% which, looking at Figure 2 is only slightly lower than investment grade credit and higher than long duration sovereign bonds.

Figure 2 – Broad SCR Comparison

The dark green line is where all of the strategy’s derivative positions are treated as risk mitigating and have an expiry of less than 12 months. In this case they are treated as ‘rolling hedges’, such that each instrument receives its full risk mitigation potential. It is unlikely that all short dated derivative positions qualify under the strict EIOPA definition of a rolling hedge.

Note that the average of the best case lies around 2% to 3%, with far less volatility in the charge as it should be independent of when these short-dated derivative positions are rolled.

Figure 2 – Broad SCR Comparison

Industry discussion on short-dated derivatives

Industry discussions show that the treatment of short-dated derivatives remains a regular point of consideration. In correspondence with the European Insurance and Occupational Pensions Authority (EIOPA) during a Solvency II call for advice on potential regulatory changes, the Actuarial Association of Europe highlighted how these instruments can play a valuable role in risk management. They noted that “the current approach risks undermining strategies that could better hedge risks while adhering to shorter-term derivative instruments.”

The Association also emphasised the broader role such instruments can play, remarking that “there is a need for a more nuanced approach, recognising the efficacy of short-dated derivatives in holistic risk mitigation strategies.” These comments reflect the ongoing industry dialogue on how best to balance the prudential aims of the framework with the practical benefits of short-dated derivatives in managing risk.

In response, EIOPA outlined its rationale for limiting the risk mitigation impact of short-dated instruments. One of the key advantages identified was the benefit of “reducing the renewal risk” associated with rolling contracts, alongside the need to ensure that new arrangements are sufficiently similar to those they replace. At the same time, EIOPA acknowledged that such restrictions “may prevent insurers from adjusting their risk mitigation to changes in their risk position on a timely basis.”

They also noted that exposure adjustments are permitted on a weekly basis to prevent the build-up of large unhedged positions as markets move. In addition, derivative positions must have a contract length of at least one month at inception, with flexibility to change into contracts of different maturities, for example, shifting from one-month to three-month futures and back again.

Finally, EIOPA cautioned that “dynamic hedging strategies where a constant adjustment of the portfolio is necessary can be highly risky.” In particular, they noted that dynamic replication of a put option would not meet the “similarity” requirement, as the impact of an instantaneous shock could differ substantially from the intended 12-month risk mitigation.

It’s our opinion that Relative Value strategies are often unlikely to qualify as rolling hedges under Solvency II because they rely on frequent execution and dynamic repositioning. The replacement of expiring options or futures is not automatic, but instead depends on the availability of relative value opportunities at the time. This means short-dated derivative positions generally do not meet the strict criteria for rolling hedge recognition. As a result, we believe their risk-mitigating impact would be typically pro-rated according to their remaining time to maturity, rather than being fully credited for risk reduction benefits.

Conclusion

Solvency II classifies derivatives into three categories: Risk Mitigating, Efficient Portfolio Management, and Speculative. While this framework provides clarity, the treatment of short-dated derivatives introduces complexity. Depending on expiry and whether positions qualify as rolling hedges, the same relative value strategy can produce very different capital charges, from bond-like levels in the best case to materially higher outcomes in the worst case.

For relative value strategies, this means that regulatory capital requirements may vary not because of changes in underlying economic risk, but because of classification and timing effects. Industry discussion continues around whether short-dated instruments, which are often central to risk-controlled RV approaches, should receive broader recognition for their hedging benefits.

Ultimately, the challenge for insurers and asset managers alike is to understand how derivative classification translates into Solvency Capital Requirement outcomes, and to account for this variability when assessing the role of relative value strategies within a diversified portfolio.

Important Information

This material has been prepared by Ardea Investment Management Pty Limited (Ardea) (ABN 50 132 902 722). Ardea is the holder of an Australian financial services licence AFSL 329 828 and is regulated under the laws of Australia.

This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe or interests and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws.

This document has been prepared without taking into account any person’s objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting.

This document is provided to you on the basis that it should not be relied upon for any purpose other than information and discussion. The document has not been independently verified. No reliance may be placed for any purpose on the document or its accuracy, fairness, correctness or completeness. Neither Ardea nor any of its related bodies corporates, associates and employees shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the document or otherwise in connection with the presentation.