The Case For Relative Value Remains Strong

It has been a challenging year for investors. Safe-haven assets, particularly longer dated government bonds, have suffered spectacular losses and while equity markets on average remain positive year-to-date, more recent performance has left many investors bloodied and bruised.

The performance of non-traditional investment strategies has also varied widely creating a challenge for investors who (sensibly) combine both traditional and non-traditional strategies within their portfolios. However, divergent performance is exactly what should be expected from uncorrelated investment strategies and as such, the case for absolute return remains strong.

Absolute return strategies typically have a low correlation to traditional asset classes and while that may lessen their appeal when those assets are outperforming, this low correlation can provide valuable diversification benefits by dampening portfolio volatility and reducing the severity of drawdowns in times of stress. Stability of returns is particularly important in portfolios that are reliant on, or have come to expect a certain level of performance or where an investor simply desires less volatility.

Perhaps the biggest challenge for absolute return managers has been the rapid rise of interest rates, with performance targets of Cash plus 2% or even Cash plus 4% considered to be “less attractive” now money market rates are materially above zero. And while the rationale for this point of view can be debated, if cash plus targets are no longer attractive, perhaps we should ask why are bond and equity funds are not being swapped for money market products given short term interest rates exceed bond and equity market yields in many developed market economies?

To be clear, Ardea are not suggesting that investors should reduce their exposure to bonds or equities. In fact, our investment approach is to avoid making decisions based on a macro-economic view, but we do believe absolute return strategies such as the Ardea Global Alpha Fund can provide a valuable benefit in reducing volatility and diversifying risk in both multi asset and fixed income portfolios.

A significant risk in the current environment is the potential for government bond yields to move yet higher. This is certainly the case in the United Kingdom where inflation is running at more than three-times the Bank of England’s target and could prompt further policy tightening. In addition, upward pressure on gilt yields is likely to come from increased government bond issuance and active selling by the Bank of England, which intends to hold four (sale) auctions in each of the short, medium and long maturity sectors during the fourth quarter, with a planned size of £670 million per auction.

Corporate bonds face the same upward pressure on yields (downward pressure on prices), but with greater potential for default. S&P Global Ratings’ 2023 global corporate default tally reached 107 at the end of August following 16 defaults in that month alone – the highest August monthly tally since 2009. According to S&P, Media and entertainment defaults, so far in 2023, are six times higher than at this point in 2022. Rating agencies Moody’s and Fitch both forecast the US high yield default rate to reach 5% in the next twelve months, reflecting the cost of higher interest payments at a time when slowing economic growth threatens company earnings.

The Ardea Global Alpha Fund focuses on non-directional (relative value) opportunities in the global fixed income markets. Investment performance is independent of the level of bond yields, the direction of interest rates and macro-economic variables, which makes it a good alternative to traditional government bond portfolios. Importantly, our approach is duration neutral and excludes credit.

As such, the Global Alpha Fund works particularly well as a diversifier of corporate credit. This is because the risk of owning a corporate bond is similar to the risk of selling a put option, where coupon income represents the premium received in selling the option and default risk reflects the potential for large losses should that option be exercised. In this regard, holding a corporate bond is like being short volatility.

In contrast, Ardea’s strategies are long volatility by virtue of the wide array of relative value strategies we employ and the use of (long) options to both limit downside and exploit pricing anomalies in bond and interest rate markets. This long volatility profile enabled the fund to deliver a strong positive return in September 2022 when the UK gilt market was to laid waste by the LDI crisis and again in March 2023 when the collapse of two regional banks in the United States and Credit Suisse in Europe threatened stability within the banking sector.

The same diversification benefit is evident in comparisons between the Ardea Global Alpha Fund and traditional equity market investments, although it may be worth commenting on the changing relationship between bonds and equities.

Conventional wisdom tells us that bond and equity markets are negatively, or at least lowly correlated, meaning that they move in an unrelated manner and while that is certainly true over the long run, this relationship changes over time. In fact, if we look at the rolling 3-year correlation between government bonds and equities in the UK we observe a positive relationship (circa 30%), yet only twelve months ago that same relationship was negative (circa -19%). An analysis of the US market yielded similar results. Does that mean bonds and equities no longer diversify each other?

In an article published in The Journal of Investing (October 2021), Ardea’s Head of Research Dr Laura Ryan argues that the narrative suggesting bonds no longer diversify equities because of low yields and a potential shift in bond / equity correlation fails to consider the importance of bond volatility in reducing overall portfolio volatility.

Dr Ryan suggests that bond / equity correlation should be a secondary consideration after relative volatility and that bonds will continue to provide diversification if bond volatility is lower than equity volatility, even if the correlation is positive. Naturally, greater diversification can be achieved under negative correlation, but this is secondary to the impact of relative volatility.

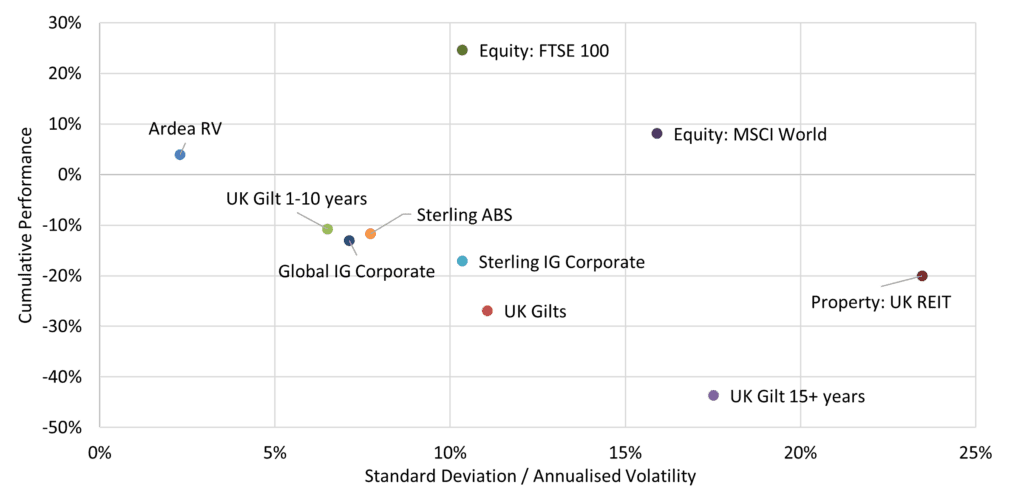

This logic can also be applied to the Ardea fund, whose volatility profile is generally lower than that of mainstream bond and equity markets today, and whose performance is a function of many small, non-directional relative value trades rather than bets on the path of interest rates or any other macro-economic variable. This is illustrated in the below scatter chart, which plots performance against volatility for the Ardea Global Alpha Fund and a number of core assets since that fund’s inception at the end of March 2021.

Performance vs. volatility: March 2021 to September 2023

Source: Bloomberg as at 30 September 2023

Finally, the absence of duration, credit and foreign exchange risk means the Ardea relative value strategy works particularly well for insurers in terms of their Solvency II capital charge and has been proven to improve risk-adjusted returns, while providing downside protection during periods of market stress.

Please refer to the important information in the attached document. The fund referenced in this document is only available in Austria, Belgium, the UK, Germany, Finland, France, Ireland, Italy, Luxembourg, Sweden and any other jurisdiction where this fund may be available without registration.