The FED Goes From QE To QT

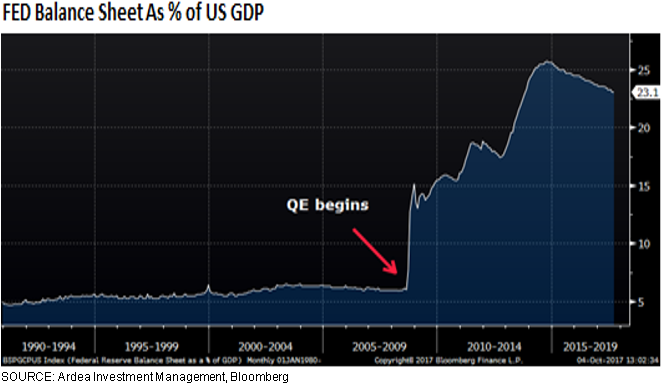

In September the FED announced its much anticipated plan to start gradually shrinking its balance sheet (Quantitative Tightening – QT), following nine years of QE (Quantitative Easing – QE) that resulted in the FED growing its balance sheet to an unprecedented $4.5tn and owning 23% of the US government bond market.

The plan is for balance sheet reduction to begin in October by gradually ceasing reinvestment of proceeds from maturing bonds rather than outright sales of existing holdings. As the plan was in line with prior guidance, the initial market reaction was very muted.

However, it still remains to be seen how this plays out. The base case may be the benign view that QT won’t disrupt markets as it will proceed very slowly, but with bond yields near historic lows and growth asset valuations at or near record highs, investors are not getting well compensated with risk premium to bet on that benign base case.

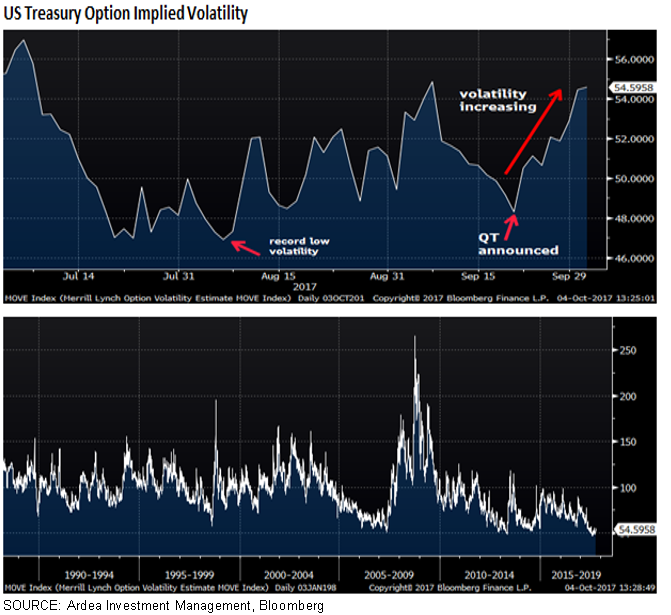

While, With US Treasury implied volatility bouncing off historic lows, option markets may be starting to price in some of the uncertainty associated with QT, but volatility remains extraordinarily low by historic standards. This means interest rate options are still extremely cheap to hedge/bet against that benign base case.

Ardea Investment Management