WYSIATI

The 2017 Nobel Prize in Economics was awarded to Richard Thaler for his work on behavioural economics. Thaler’s work built on the foundation established by another Nobel Prize winner, the psychologist Daniel Kahneman.

Kahneman, together with his late colleague Amos Tversky, explored the many cognitive biases that impair our decision making, particularly in relation to uncertain events, and coined the acronym WYSIATI – What You See Is All There Is.

This bias causes individuals making a decision to overweight information that is readily visible, for example recent history, while ignoring information that is not … even if that information is known to be relevant.

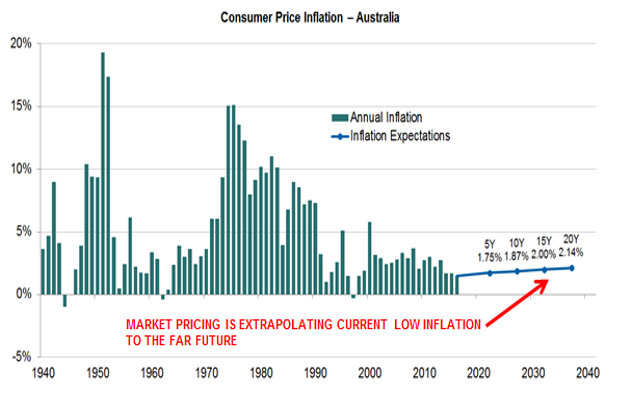

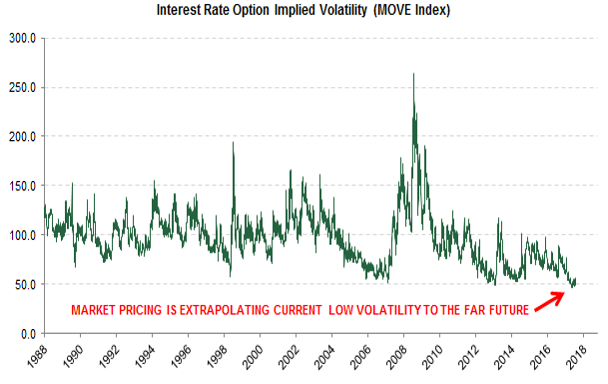

WYSIATI may well explain the unusual pricing evident in parts of financial markets today, such as extremely low forward inflation expectations and option implied interest rate volatility.

While both these are supposed to reflect future uncertainty (which is not readily visible), they are in fact more anchored to recent history, which is readily visible but may not at all be reflective of the future.

This dynamic creates pricing inefficiencies that investment strategies can exploit for attractive risk-adjusted returns.

The charts below highlight two such opportunities in inflation curves and interest rate volatility.

Both show that markets are extrapolating current benign inflation and low volatility conditions far into the future, making it very cheap to position for future uncertainty. In the former case this can be done via inflation curve steepening positions and in the latter case via buying interest rate options.