5 Key Risks Impacting Fixed Income for FY20

With the start of a new financial year, it’s common for investment managers and banks to issue their predications for what the year ahead holds for client portfolios. In the fixed income (FI) arena, there has already been plenty written about predictions for economic growth, the future direction of interest rates and whether or not bond yields can keep going lower.

At Ardea Investment Management, we adopt a pure ‘relative value’ investment approach that is independent of all these considerations. While they do inform our analysis, they don’t drive our returns.

But what we can point out with confidence is how the structural dynamics of fixed income markets might skew the risk and reward dynamics for investors. As such, we’re approaching this topic from a different angle by revisiting some fundamental FI concepts in the context of the extraordinarily low interest rates and bond yields seen around the world today.

In this article, we will discuss five key risks to fixed income markets for FY20 and explain their relevance to those allocating to fixed income investments.

The key takeaways are that ultra-low bond yields fundamentally change the risk vs. reward proposition of bonds and challenge conventional assumptions about how bonds behave.

With the starting point of global bond yields already so low, looking ahead to FY20 the oft used disclaimer that past performance is not indicative of future returns is very relevant.

For those thinking about the diversification value of FI allocations in a broader portfolio, it’s important to look beyond labels and not simply take at face value the ‘defensive’ moniker applied to bonds.

In the following sections, we cover 5 fundamental concepts that drive the behaviour of FI investments, focusing specifically on conventional investment grade government and corporate bonds that comprise the bulk of the easily accessible FI investment universe.

Risk One: The Vanishing Yield Cushion

Most investors expect bond investments to deliver two things;

- a stable income stream

- defensive risk diversification (basically, perform well when stocks fall)

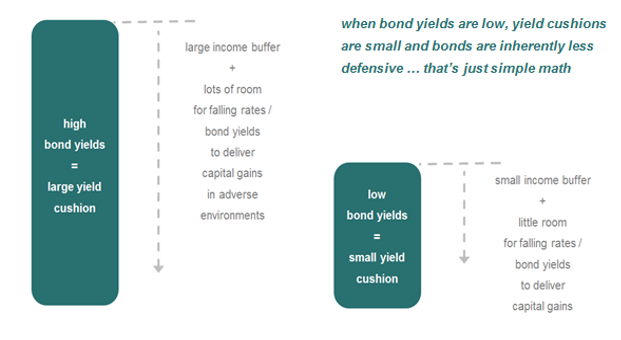

For conventional bond investments, the ‘yield cushion’ is a key determinant of how well they meet these expectations.

The interest paid on bonds, together with the possibility of falling bond yields delivering additional capital gains in adverse market environments, combine to form the ‘yield cushion’. This is what allows bonds to provide a stable income stream and protection when stocks fall.

When bond yields are high, the yield cushion is large and bonds do a good job of meeting these expectations. But when bond yields are extremely low, as they are today, bonds deliver less income and are inherently less defensive.

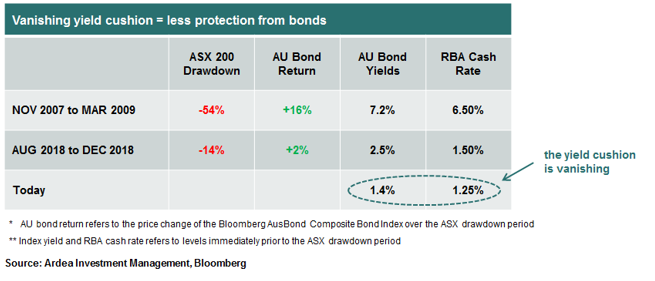

The impact of lower yields on the diversification value of bonds is shown in the table below, which compares the positive returns delivered by AU bonds during two ASX200 drawdown periods. While this example is AU specific, the dynamics are universal.

The takeaway for FY20 – Don’t assume that conventional bond holdings will provide the same protection against equity losses as they have in the past.

Risk Two: Changing Bond vs. Equity Correlations

While past 1-year returns for bonds have been extraordinarily strong, the bulk of this return didn’t occur during the Q4 2018 equity drawdown but rather in 2019, as equities have also performed strongly.

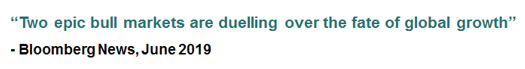

Rallying bond markets are strongly anticipating central bank rate cuts, in response to slowing economic growth. Yet equities are also rallying.

Referencing this seeming disconnect in bond vs. equity performance, Bloomberg ran with this headline;

They went on to explain, “In the simplest terms, bonds investors are screaming recession, while equity and credit traders refuse to hear it.”, referring to the conventional analysis framework in which bonds rallying in anticipation of weaker economic growth would suggest equities perform poorly.

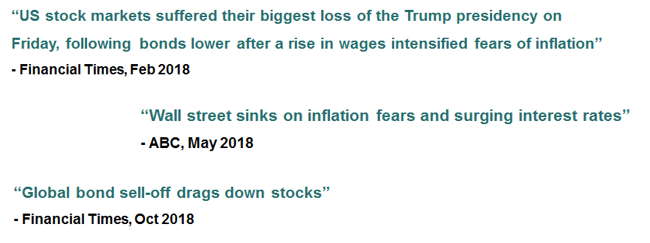

So this year bonds and equities are rallying together, while last year the opposite happened.

In 2018, the expectation of stronger economic growth, rising inflation and higher rates in the US caused global equity and bond markets to sell off in unison, triggering headlines like these;

What all this points to is the unstable nature of bond vs. equity relationships, which has broader relevance because most balanced portfolio construction frameworks rely on a single assumption – a negative correlation between equity and bond prices.

The expectation is that when equity prices fall, bond yields also fall and therefore the interest rate duration exposure inherent in bonds delivers capital gains to offset equity losses.

Following from this, interest rate duration has been the main diversification play relied upon over the entire career span of most portfolio construction professionals active today.

However, the experience of 2018, together with a longer history prior to the 2008 financial crisis, shows that bond-equity correlations are actually not stable, and the negative correlation assumption doesn’t always hold.

These issues become most relevant when the starting point for bond yields is already very low and central bank actions are dominating markets … the exact conditions we face today.

The takeaway for FY20 – It’s now too risky to pin an entire risk diversification strategy on the single assumption of a negative correlation between bonds and equities. (We covered this topic in detail here.)

Risk Three: Asymmetry of Interest Rate Duration Risk

The interest rate risk inherent in bonds (i.e. duration risk) stems from the sensitivity of bond prices to changes in the general level of interest rates or bond yields. When bond yields drop, bond prices go up, resulting in capital gains for bondholders. The opposite happens when yields rise.

Meanwhile, a bond’s yield can be viewed as the compensation a bondholder gets in return for taking duration risk and as bond yields globally have declined, this compensation has declined as well.

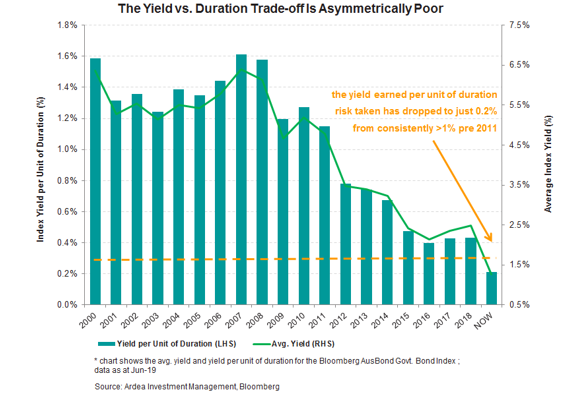

For example, this chart shows that the yield earned per unit of duration risk inherent in a portfolio of AU govt. bonds is now almost zero.

This is particularly relevant today because bond returns become asymmetric when yields get very low.

Unlike with equities, the upside potential in bonds is inherently capped. Even if stocks are expensive, there is no real limit to how high they can go. Bond prices on the other hand are bounded by the fact that returns are limited to interest payments received over the life of the bond.

Over shorter time horizons, bond prices fluctuate as bond yields move around and this can be an additional source of capital gains or losses.

The asymmetry then becomes even more pronounced because bond prices can’t keep going higher unless yields go lower. But when the starting point of yields is already low to begin with, there is naturally less room for them to drop further.

As the experience of Japan and Europe shows, there is strong resistance to bond yields going far below zero, because a long-term investor buying bonds with negative yields would be locking in a guaranteed loss.

Therefore, as yields get very low, the return profile of bonds becomes unfavourably asymmetric, which is what makes chasing bonds at record low yields (i.e. record high prices) very different to chasing stocks at high valuations. Stocks can keep on going up indefinitely, while bonds can’t.

Using the index in the chart above as an example, if yields revert even modestly to where they were as recently as December last year, AU bonds would incur a capital loss of about 7%. But to generate a gain of that magnitude the index yield would need to drop to an eye wateringly extreme level of just 0.1%.

With compensation for duration risk so asymmetrically poor, it’s hard to justify hanging onto duration exposure at current levels unless you have very strong conviction that yields keep going lower.

Of course, it’s possible that can happen (e.g. in a very negative economic scenario), but then again maybe yields go back to 2018 levels if economic growth doesn’t collapse.

These directional market calls are very hard to get right consistently, which is why we don’t take these types of risks in our portfolios. Recall, it was only last year that the forecasting crowd was convinced that rates would only go up and now that same crowd says rates will only go down.

The takeaway for FY20 – Blunt duration exposure is currently an unfavourably asymmetric bet and even if you’re just using it to protect against equity losses, it’s currently a very expensive insurance policy. (We covered this topic in detail here.)

Risk Four: Hidden equity beta in fixed income portfolios

As govt. bond yields have dropped to extraordinarily low levels there has been growing pressure on investment managers to find returns elsewhere, which is why credit investments have become a favourite FI sub-asset class for yield hungry investors.

As a result, we’ve noticed a ‘credit creep’ phenomenon whereby even ‘defensive’ FI portfolios have consistently increased allocations to credit investments in search of higher yields.

In fact, this persistent credit overweight may have actually been THE dominant driver of active FI fund performance, as this research paper pointed out;

“We find remarkably consistent results across categories: a large portion of active FI manager returns can be explained by exposure to credit markets …

This is hardly comforting for an investment into an asset class that is meant to provide diversification from equity markets”

AQR, “The Illusion of Active Fixed Income Diversification” 4Q17

Credit investments are not inherently good or bad. Rather it’s about compensation for risk and how those risk exposures will behave in different scenarios.

It’s easy to generate higher short term returns by simply taking more risk but often that additional risk isn’t obvious until the economic environment changes or some unexpected catalyst comes along.

For those thinking about portfolio diversification, recognise that credit investments have latent equity beta and can therefore become highly correlated to equity losses in adverse economic scenarios. This phenomenon becomes more pronounced when yields are very low.

The takeaway for FY20 – Hidden equity beta in FI portfolios is a big potential pain point. (We covered these topics in detail here and here.)

Risk Five: Liquidity

Liquidity is one of those things that doesn’t get much focus until it’s too late.

The common assumption is that investment grade bonds are liquid and while this does hold for a specific subset of very high-quality govt. bonds, it is no longer true for a growing portion of the corporate bond sector.

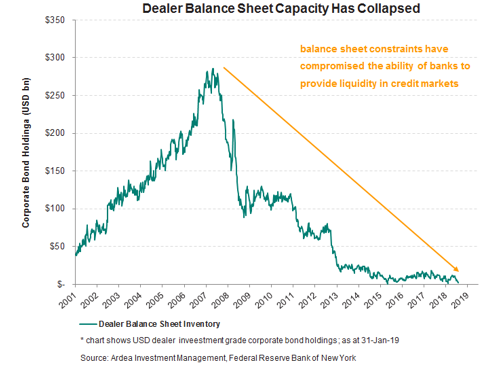

Bond markets are heavily reliant on banks acting as intermediaries to facilitate buying and selling by investors. Unfortunately, an unintended side effect of post 2008 bank regulations, balance sheet constraints and rising cost of capital has been a structural deterioration in corporate bond market liquidity.

As the chart below shows, the amount of corporate bond inventory that banks are willing to hold has collapsed due to balance sheet constraints, which directly compromises liquidity in these markets.

The only reason this hasn’t been more obvious is that we’ve been in such a bull market for credit, with yield chasing inflows masking this secular liquidity deterioration. It’s only when credit inflows turn to outflows that the liquidity problems become visible.

So far this year there have already been three incidents of high profile ‘liquid’ funds running into illiquidity problems, and this has happened while bull market conditions continue. (See here, here and here)

What happens when market conditions change?

The takeaway for FY20 – Lack of liquidity is an underappreciated risk in FI markets and if you’re going to take illiquidity risk, make sure it’s explicitly acknowledged and adequately compensated.

Conclusion

With interest rates and bond yields now so low it has become more important to look beyond labels and challenge conventional assumptions about fixed income investments.

While there is certainly a role for bond beta (i.e. duration and credit) in broader portfolios, especially as it’s easy to understand and cheap to implement, it’s a blunt instrument that tends to work best in high yield / low volatility environments.

Given we’re in precisely the opposite environment right now, alternative FI approaches that can access different return sources become more relevant and what we’re really excited about is the growing opportunity around FI market inefficiency that rising volatility brings.

Looking ahead to FY20, whichever option investors choose to go with, our advice is to scrutinise FI investments carefully, question whether they adequately compensate for risk, think about how they will interact with other investments and have realistic expectations about past performance vs future returns.

The information in this article has been prepared on the basis that the Client is a wholesale client within the meaning of the Corporations Act 2001 (Cth), is general in nature and is not intended to constitute advice or a securities recommendation. It should be regarded as general information only rather than advice. Because of that, the Client should, before acting on any such information, consider its appropriateness, having regard to the Client’s objectives, financial situation and needs. Any information provided or conclusions made in this article, whether express or implied, including the case studies, do not take into account the investment objectives, financial situation and particular needs of the Client. Past performance is not a guide to future performance. Neither Ardea Investment Management (“Ardea IM”) (ABN 50 132 902 722, AFSL 329 828), Fidante Partners Limited (“FPL”)(ABN 94 002 835 592, AFSL 234668) nor any other person guarantees the repayment of capital or any particular rate of return of the Client portfolio. Except to the extent prohibited by statute, neither Ardea IM nor FPL nor any of their directors, officers, employees or agents accepts any liability (whether in negligence or otherwise) for any errors or omissions contained in this article.