Is It Really That Simple?

Some chart fun below, from which you can draw your own conclusions.

It’s our view that the paradigm shift currently taking place – from a post-GFC environment in which synchronised global central bank stimulus created abundant liquidity and low rates, to a more normalised rate environment that isn’t distorted by central bank asset purchases (quantitative easing – QE) – has far reaching implications for assets prices across all markets (refer to – ‘The Music May Still Be Playing But The Bar Tab Is Running Out’).

In December we wrote – “Much like the effects of alcohol, extreme central bank intervention has arguably clouded judgement on risk and asset pricing – near zero interest rates can make any asset look attractive – but 2018 may well be the year that more sober valuation re-asserts itself.”

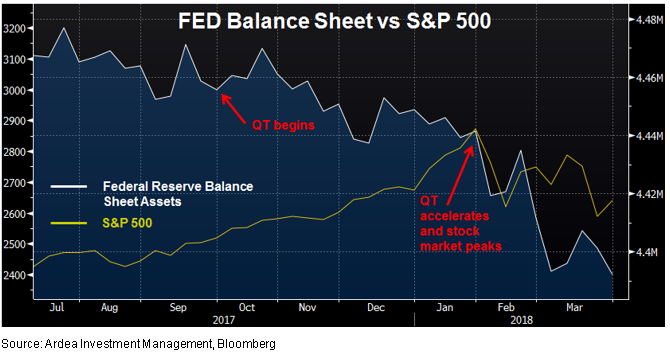

The official start date for the FED’s quantitative tightening (QT) plan – it’s plan to reverse years of QE by gradually shrinking its balance sheet – was 1st October 2017 but it was only from February 2018 that balance sheet reduction really accelerated, which happens to coincide nicely with the recent peak in the US equity market.

So is it really that simple – years of QE pushed up asset prices and now QT will bring them back down?

Back in September, we noted the following in relation to QT;

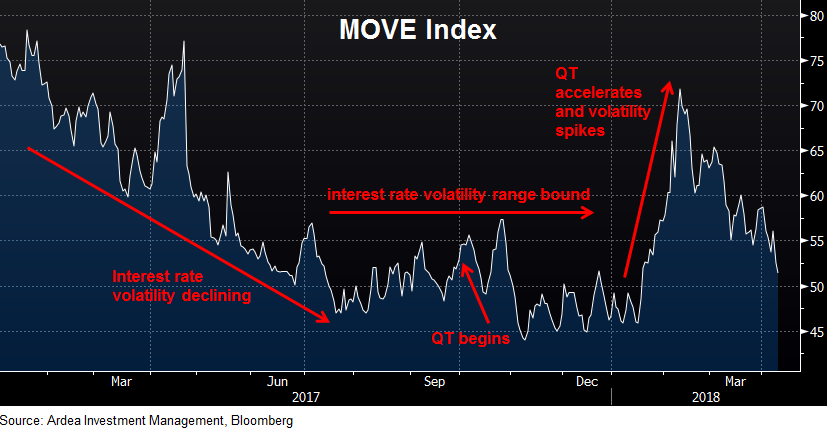

“The base case may be the benign view that QT won’t disrupt markets as it will proceed very slowly, but with bond yields near historic lows and growth asset valuations at or near record highs, investors are not getting well compensated with risk premium to bet on that benign base case.

While, with US Treasury implied volatility bouncing off historic lows, option markets may be starting to price in some of the uncertainty associated with QT, but volatility remains extraordinarily low by historic standards. This means interest rate options are still extremely cheap to hedge/bet against that benign base case.” (refer to – ‘The FED Goes From QE to QT’ for details).

Here’s what’s happened to interest rate volatility since then, as measured by the MOVE index, which tracks average volatility implied by US interest rate options.

Interest rate volatility strategies remain a very attractive way to protect fixed income portfolios from periods of market stress.

Ardea Investment Management