Linkers surge on UK inflation shock: a British history lesson

The events surrounding Brexit have spun off many important lessons for markets, not least of which is the importance of considering all possible outcomes when assessing risk in financial markets.

One of the more obscure lessons of Brexit however is still very much in the making. This lesson relates to the rarely appreciated qualities of a peculiar backwater of the government fixed income universe, known as inflation linked bonds, or more affectionately, linkers.

The lesson is simple enough: returns on UK inflation linked bonds have surged, with a currency-hedged return for Australian investors of 27% over the past year. Investors with unhedged currency exposure would have benefited even more from the UK Pound depreciation as well.

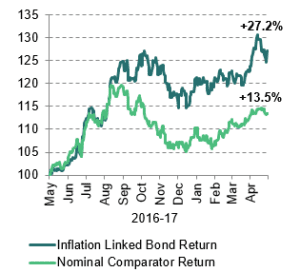

UK government bond returns (hedged to AUD)

Returns of this magnitude are rare for any asset class, and almost unheard of in the low risk, highly liquid government bond markets of the world’s safest and most stable sovereign countries.

The trigger for these bumper returns was a pronounced shift in inflation expectations, large enough to be called an inflation shock.

This is an event that has been seen only rarely in the history of financial markets, and hasn’t been observed in over 30 years, yet is also extremely damaging for investors.

The cause of this inflation shock was a sharp collapse in the value of the UK currency, pound sterling, as markets began to lower their expectations of economic growth in the Brexit aftermath. With the UK facing larger tariffs for its export goods, its currency will likely experience a drop in demand once Brexit occurs. This explains the fall in the current exchange rate.

The knock-on effect from a weaker currency is imported inflation: that is, a weaker exchange rate raises the price of consumer goods which, in the case of the UK and most other advanced economies, are largely sourced from abroad.

This expectation of a sharply lower currency, and sharply higher inflation in future, means that assets indexed to inflation can be expected to perform much more strongly than otherwise, resulting in the bumper 27% return.

Importantly, only inflation linked bonds provide direct indexation of their return to inflation.

Many other inflation hedges are available, such as property, infrastructure, and even blue chip equities. However these all provide a heady dose of high-growth exposure, which tends to drown out any inflation hedging they may offer.

For the specialist investors who trade government linkers, these developments are of great interest as they are rarely observed “in the wild.”

They also provide real-world proof of the unique properties of inflation linked bonds. Until now, these properties have been largely academic, as they haven’t been observable in the universe of historical investment returns used to set return expectations.

Financial market historians know that one must look back a number of decades to the major inflation shock in the 1970s, or to emerging markets such as Zimbabwe, to identify earlier inflation shocks.

The applicability of these instances to modern advanced economies seems remote, so the recent experience of the UK is an important reminder that linkers can still deliver in spades for investors.

How was the 27% return on UK linkers achieved?

The 27% return on linkers deserves further elaboration given the sheer magnitude of the return on a low-risk government bond asset.

Inflation linked bonds pay a real yield and an inflation indexation, and as such their values are sensitive to changes in real yields and changes in inflation expectations.

A fall in real yields will make existing bonds with higher coupons more valuable, thus boosting their returns (and vice versa). Likewise a rise in inflation expectations will provide a larger indexation in future, also making existing bonds more valuable.

UK linkers benefited from both effects over the past year. Real yields declined by about 80 basis points, while inflation expectations rose by about 50 basis points (exact amounts vary depending on maturity).

Given the very long duration of the UK linker universe, at around 23 years, this was enough to deliver a 13.5% return from real yields, and a 13.6% return from inflation expectations.

Can the UK experience be repeated elsewhere?

The events in the UK may seem isolated, and not likely to be repeated elsewhere.

However, any long-duration linker market that experiences the same shocks to inflation expectations and real yields as the UK can expect to see similar performance outcomes.

This is comforting, as the UK experience provides evidence that inflation linked bonds perform exactly as expected in delivering robust protection against inflation surprises.

How likely this is in other markets such as Australia is something that will only be known in the fullness of time. That said, the tendency of the Australian dollar to trade the full range (and then some more for good measure) means that imported inflation should not be overlooked.

For this reason we continue to favour inflation linked bonds as providing almost bottomless inflation protection, in the event of a true inflation shock.

The starkly different performance on offer from linkers, especially in contrast to other growth-oriented inflation hedges, means they deserve worthy consideration in diversified portfolios.

As Brexit and the modern British history lesson has shown, one never knows when the unexpected can happen, and a 27% return might be just around the corner.

Ardea Investment Management