Macroprudential tools in Australia

Measures under consideration

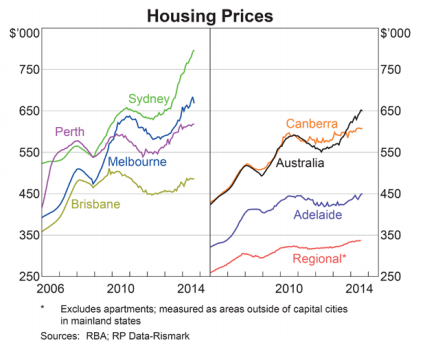

In recent months the Reserve Bank has focused on the role of investors in driving house price appreciation in the key centres of Sydney and Melbourne. These comments have increasingly begun to indicate that if additional measures could be taken to rein in price movements, then this might not be a bad thing.

Such measures would be aimed at protecting the stability of the financial sector against lending deemed excessively risky, and thus would be implemented in close coordination with APRA. Measures would also be aimed at avoiding an excessive run up and subsequent correction in house prices, which could prove damaging to both owneroccupiers and investors, and the household sector more generally.

While there has been no formal statement of the likely content of such measures, RBA officials have indicated that an announcement could be made during December. Officials have also suggested that any measures announced would not involve blanket restrictions, caps, or quotas, and would not resemble either the earlier era of financial regulation in Australia, or more recent versions of macroprudential controls such as the LVR caps recently implemented in New Zealand. Instead, the measures would be narrowly targeted, and focused squarely on the investor segment of the market.

In the RBA’s view, investors are among the least leveraged sectors of the market due to their use of the primary home or other assets as collateral. However, this also means that they are the market sector most able to refinance, and therefore most able to purchase investment properties. It would appear that the RBA’s concerns around investor activity do not relate to financial risks to investors themselves, but are instead focused on the knock-on and amplification effects of investor activity on the broader housing market.

An investor-led ramp-up in prices, if left unchecked, could lead to excessive risk-taking by other sectors of the housing market. Compared to investors, these other sectors are less able to withstand adverse shocks, and include the lower-income and first home buyer segments.

This approach is a rather pragmatic one, as the RBA has recognised that in performing its financial stability function, it needs to work within the current taxation and financial policy landscape set by Canberra, and therefore the best approach is to try to alleviate the symptoms of the current regime, rather than address any underlying causes. This approach is a sensible one.

Slightly more difficult however is the attempt to implement this policy by targeting the investment sector of the housing market. Historically, attempts to limit or restrict the activity of specific groups or sectors have been difficult to implement, and have often met with resistance or been circumvented in some way.

Targeting one sector of the market in order to protect the stability of other sectors, or of the market overall, is also a mildly convoluted approach. While in our assessment it is the right approach to take, the additional complexity of a targeted approach rather than a blanket restriction may prove more difficult to explain to stakeholders and to the public.

Portfolio implications

The introduction of a macroprudential framework in Australia should be seen as a positive by market participants, as it would provide additional flexibility to assist in balancing stability in the housing sector with the needs of the broader economy.

All other things being equal, to the extent that macroprudential measures can be used as a pure substitute for the conventional approach of raising the cash rate, then at the margin cash rates may be incrementally lower in Australia going forward. Importantly however, the use of macroprudential measures does not affect the many other economy-wide reasons for changes in interest rates, so the effect is probably marginal at best. It is also likely that macroprudential measures and monetary policy will rarely be perfect substitutes, and more often will be working in close coordination.

Moreover, if over the longer term macroprudential measures are able to further lower the volatility of the economic cycle in Australia, then if anything this stability would be consistent with a marginally higher rate of long-term economic growth. Higher growth has historically been associated with higher real rates and thus a higher average cash rate.

At a more practical level, the formal announcement of such measures could be perceived as further opening the door for rate cuts in Australia, should they be required. As such we would expect market expectations for the cash rate to decline further on any announcement of macroprudential measures. Such an announcement could also carry some element of surprise for markets, as while the potential for an announcement has been well telegraphed, the consistent series of “period of stability” policy statements has been effective in reducing expectations of any activity from the RBA over the near term.

The expected announcement of macroprudential measures is also consistent with other policy initiatives, in particular the report of the Financial System Inquiry which is expected to encompass measures to boost the robustness of the banking sector against potential threats. Given close coordination between the RBA, APRA, ASIC and the Treasury, we would expect some degree of consistency across all of their respective initiatives.

We expect to have considerably more detail on the specific measures to be used and their operation once a formal announcement is made, and will provide a further update as more information becomes available.

Ardea Investment Management