Market Mechanics: Cross-Currency Issuance – A Quiet Shift in Sovereign Funding

One of the more interesting technical shifts this year has been the rise in foreign-currency issuance by European sovereigns and supranationals, as issuers look to diversify beyond increasingly crowded EUR markets. This is not a macro story, but a microstructural one driven by pricing, investor depth, and curve dynamics.

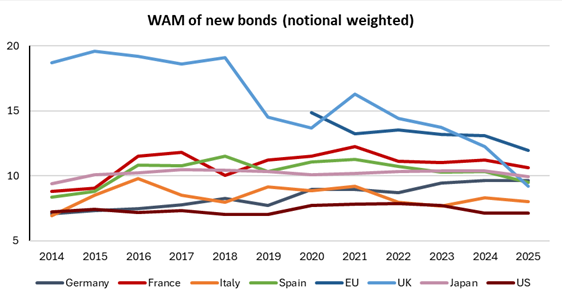

Before considering cross-currency flows, it is worth noting a broader backdrop: weighted-average maturities (“WAM”) of new sovereign issuance have been drifting lower across Europe, the US and Japan. Issuers are bringing shorter-dated supply to market, reflecting both refinancing needs and a more cautious approach to locking in long-term borrowing costs. As EUR sovereigns issue less at the long end, the relative scarcity of long-dated paper increases the appeal of the EUR market for foreign issuers, which can find deeper investor demand and greater capacity to absorb large-volume, longer-dated issuance than is available in their domestic markets.

Source: Goldman Sachs, December 2025

European issuers have also taken advantage of favourable cross-currency levels, raising longer-dated funding more cheaply in USD or AUD than in EUR. Doing so not only reduces their reliance on domestic markets, but also taps into deep demand for high-quality non-US issuers in USD markets. KfW is a clear example: in 2025 it issued across ten currencies – including USD, GBP, HKD and CHF – and remains the largest foreign issuer of green AUD bonds.

Management at KfW has highlighted the strength of demand for these foreign-currency lines as a key driver of its diversification strategy. Belgium has reported similarly strong interest in its USD issuance, particularly from US real-money investors seeking non-US duration.

At the same time, Australian issuers have moved in the opposite direction, becoming active in EUR markets through 2025. This shift is not usually cost-driven, as swapping EUR proceeds back into AUD often results in higher all-in funding costs than issuing domestically. Instead, the attraction lies in the market structure. EUR investors are willing to buy longer-dated paper in larger size than the AUD market can generally absorb. For Australian borrowers wanting to extend duration and secure larger funding volumes, tapping EUR markets can be advantageous even if the economics of swapping this back to AUD are less favourable.

These flows highlight how cross-currency issuance patterns are driven by technical market forces rather than macroeconomic views. When issuers shift funding into different currencies, they reshape supply at specific points on multiple curves simultaneously, creating pricing divergences that would not exist under a purely domestic issuance profile. Swap-back costs then layer on additional distortions, leaving certain currencies structurally rich or cheap relative to others. Meanwhile, investor demand imbalances, such as deep appetite for long-dated EUR duration or strong USD demand for high-quality non-US issuers, further pull curves out of alignment.

The combination of scarce long-dated domestic supply, heavy foreign-currency issuance, and cross-market swap dynamics consistently generates relative value dislocations across currencies, maturities and issuers. These are exactly the types of micro-level inefficiencies that Pure Relative Value strategies are designed to exploit.

In other words, beneath the headline macro narratives, it is the market mechanics of issuer behaviour, investor positioning and cross-currency flows that create some of the most compelling opportunities.

Important Information

This material has been prepared by Ardea Investment Management Pty Limited (Ardea) (ABN 50 132 902 722). Ardea is the holder of an Australian financial services licence AFSL 329 828 and is regulated under the laws of Australia.

This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe or interests and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws.

This document has been prepared without taking into account any person’s objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting.

This document is provided to you on the basis that it should not be relied upon for any purpose other than information and discussion. The document has not been independently verified. No reliance may be placed for any purpose on the document or its accuracy, fairness, correctness or completeness. Neither Ardea nor any of its related bodies corporates, associates and employees shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the document or otherwise in connection with the presentation.