QE winners become QT losers

We’ve noted previously that the transition from Quantitative Easing (QE) to Quantitative Tightening (QT) is one of the two important paradigm shifts currently taking place in markets, the other being the transition from a ‘good inflation’ to a ‘bad inflation’ paradigm (refer to – ‘Markets Wake Up To Inflation Risk’ for details).

The transition from QE to QT has far reaching implications for asset prices across all markets, something we have discussed previously (refer to ‘The Music May Still Be Playing But The Bar Tab Is Running Out’ and ‘Is It Really That Simple?’ for details).

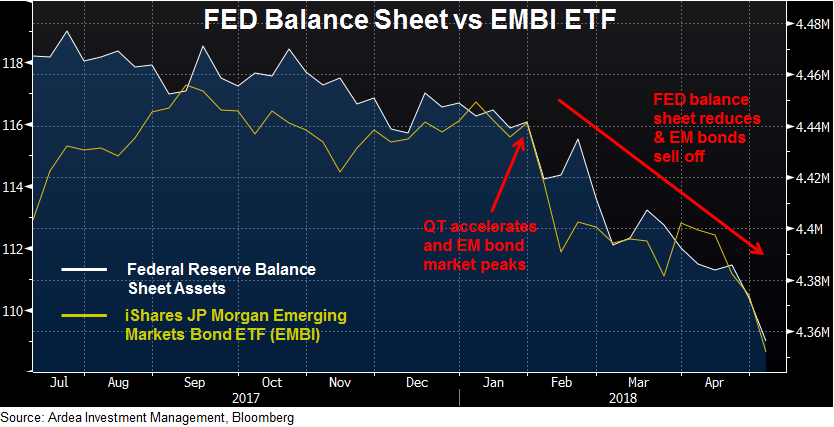

One of the biggest beneficiaries of the QE induced flood of USD liquidity has been emerging market assets, but now that dynamic is reversing.

As QT gained momentum in February this year, the point from which FED balance sheet reduction accelerated, emerging market assets have been hit hard. For example the iShares JP Morgan Emerging Market Bond ETF is one of the worst performers this year, having dropped 5% so far YTD.

In our view, this is symptomatic of a broader theme of tightening USD liquidity conditions as the effects of FED policy tightening accumulate.

This liquidity tightening first manifested in short term USD funding markets earlier this year and also spilled over into AUD markets (refer to – ‘LIBOR In The News Again’ for details). This now appears to be causing broader contagion, with the recently strengthening US dollar adding further pressure.

Last year, when emerging markets were all the rage, Argentina took full advantage to issue $2.75bn of 100 year bonds in a deal that was met with huge demand from yield seeking investors. (Never mind that Argentina had defaulted on its debts as recently as 2001 and many more times before that.)

That initially looked like a great deal as the reach for yield neared its febrile peak, pushing the bond’s price up and its yield down to a record low 6.8%. But just 10 months later, that bond has dropped 14% in value as inflation has spiked, the currency has devalued and its central bank has been forced to hike interest rates to 40%.

So it turns out that bond was a great deal after all, but for the borrower rather than the investors.

While Argentina has its own specific issues, emerging market assets more generally may well be acting as an early warning indicator of further contagion that will spread across global financial markets as the FED proceeds with tightening policy and USD liquidity dries up.

Ardea Investment Management