Rethinking Fixed Income in retirement

How Actively Managed Fixed Income Can Meet the Needs of Retirees

We have been in a period where financial market volatility has been abnormally low and as such, the focus in fixed income has become overly skewed to how much interest income can be generated, at the expense of ignoring downside risks.

For this reason, the price component of bond returns hasn’t received much attention. As we are now shifting to a higher interest rate and credit spread volatility regime, price movements become more important as they can be a far larger driver of total returns than interest income.

This is especially relevant for retirees seeking stable income generating portfolios.

Additionally, what we see in Australia is that some of the most popular income sources – equities for dividends (particularly bank stocks), bank hybrid bonds, investment properties – are closely linked to each other and can therefore become highly correlated in a downside scenario. This means they can all end up incurring losses at the same time.

So, when thinking about income sources, it’s important to consider how they will behave in different scenarios. To think about how much and what types of risks you’re taking to get that income and to consider how those risks will interact with other parts of your investment portfolio.

None of the various income options available is inherently better or worse. Rather, the focus should be on diversifying income sources to achieve a balance of risks that can navigate a range of possible scenarios – whilst still providing a stable income.

“Defensive” Fixed Income – Look Beyond the Label

Fixed income is generally labelled as a ‘defensive’ income source. However, the conventional approach to buying and holding bonds to harvest yield (or income) may not be as defensive as assumed.

This is because there are actually two sources of return from a bond. There is the interest payment and there is also the capital gain or loss from bond price movements. The interest component of a bond, assuming the bond issuer doesn’t default, is known with certainty, but what is not known is how the bond price will behave over time until it reaches maturity.

These intermediate price movements can actually be far larger than any interest received from holding the bond. This is particularly true in the current environment where bond yields are low but price volatility is rising.

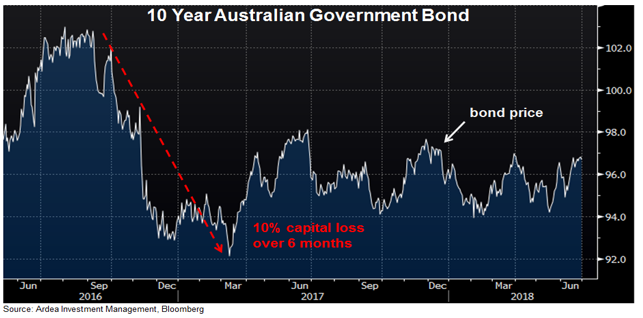

For example, the chart below shows the price of the current 10-year Australian government bond, which pays an annual interest rate of just 2.25%.

Over the 6 month period highlighted in the chart, the bond paid 1.13% interest but incurred a capital loss of 10%. This is not what is typically expected from a ‘defensive’ investment.

If you’re truly able to hold this bond to maturity the intermediate bond price movements may not matter, but if you find yourself having to sell the bond prior to maturity because you need the cash, you might be forced to crystalize a capital loss that can be far larger than all the income earned while you held the bond.

The current combination of low yields and rising interest rate volatility compromises the defensiveness of even the most defensive part of the fixed income spectrum that government bonds are supposed to represent.

What about bank hybrids?

Bank hybrids have become a popular source of income as investors have reached for yield in a low rate environment. Being neither inherently bad or good investments, the focus should be on the balance of risk vs. return and how they might behave relative to your other investments in different scenarios.

Anyone considering them as a defensive source of income should be aware of the potential for significant price volatility that can wipe out a whole year’s worth of income in just a few days, precisely at the same time that equity markets are also falling.

Bear in mind that most analysis of the correlation between Australian bank hybrids and equities uses a sample history from the last 5 years. This is a period over which both credit and equity markets have generally done very well and volatility has been low.

Australian banks have taken full advantage of these ideal conditions to issue a lot of these securities and we’re now in a situation where that growing volume of hybrids outstanding has never been tested in a real downside scenario, such as a recession.

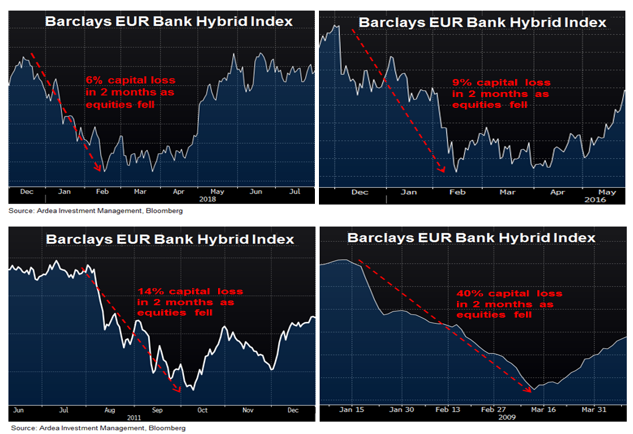

Learning from overseas experience, where these types of securities are more readily traded and have a longer history, the potential for price volatility is clear.

For example, the charts below show the behaviour of the Bloomberg Barclays Bank EUR hybrid index during various equity market sell-offs. The capital losses over the 2 month periods shown are far larger than the current average monthly yield of just 0.4%.

These charts demonstrate that bank hybrids can have a lot of latent equity beta, or hidden equity risk. This means that in benign market conditions they exhibit low correlation to equities but in times of market stress they can become highly correlated with equities and incur capital losses as equities fall … just when you need their assumed defensiveness the most. Even very large ‘safe’ banks experience significant price volatility in their bonds during these periods.

Adding further to this hidden equity risk, bank regulations have changed since the 2008 financial crisis, such that even if a bank is supported by the government and doesn’t actually default, bank hybrid securities can still incur permanent capital losses, as has been shown in Europe.

Some may point to the 2008 financial crisis, during which credit securities (including bank hybrids), experienced temporary capital losses but then rebounded sharply in subsequent years. This is true, and assuming you held on to those investments, you would have more than recovered those losses.

However, that decision to hold on and hope the losses reverse is easier to justify with the benefit of hindsight, but a far more difficult decision to make at the time, when other parts of your portfolio are also incurring losses.

Additionally, during these times it’s hard to predict the unforeseen circumstances that might force you to sell those investments and actually crystalize capital losses that are far larger than any income you could receive. For retirees, this concern is particularly acute. Retirees may need to sell securities to meet income for living expenses and have much less ability to tolerate losses and invest new capital to take advantage of lower prices.

This is why short-term volatility still matters, even for long term investors. This is doubly true when the investment is supposed to be defensive and give you a buffer against other parts of your portfolio.

An Alternative Income Source – Diversify Your Risk

Actively traded fixed income strategies are generally perceived as being higher risk than simply buying and holding a bond to collect a regular interest payment, and if you only consider the interest payments from the bond this may well be the case.

However, as explained above, the price component of fixed income returns is becoming more important as volatility rises and therefore a buy and hold approach may well prove to be the riskier one.

For this reason, certain types of actively traded fixed income investment strategies are worth considering as an alternative income source to diversify your risk and complement commonly used options such as dividend paying stocks, bonds, bank hybrids, investment properties etc.

There’s a lot more to fixed income than just buying bonds. There’s a great diversity of instruments and strategies that can be used to generate attractive returns while controlling volatility and mitigating risks.

In our view, the following four criteria are essential in deciding whether an actively traded fixed income strategy is suitable as a defensive income alternative;

1. Positive absolute returns

It should target a positive return irrespective of how market indices behave, which rules out strategies with a performance objective of outperforming a market index. Relative outperformance vs an index that has a negative return won’t deliver a stable income stream, which is the key need of retirees.

2. Tight volatility control

It should exhibit a track record of low performance volatility through different market environments and therefore rules out high volatility strategies. High volatility, even with higher average returns, is inconsistent with the objective of a reliable income stream.

3. Low correlation to equities

It’s performance should have lower correlation to equity markets, which rules out strategies with high equity beta. Most income portfolios in Australia already carry a lot of equity risk in one form or another, so it’s important that an alternative income source can deliver returns that are independent of the performance of equity markets. In particular, the strategy should not be materially affected when equity markets fall and this is where credit focused fixed income strategies can have drawbacks.

Credit assets tend to have a latent equity beta, meaning that they can behave independently of equities in benign market environments but become highly correlated to equities on the downside, thereby incurring losses at the same time as equities are falling.

4. Highly liquid

It should have underlying investments that are highly liquid so you can readily redeem your investment if you need access to your capital. Credit markets have become a lot less liquid over the past 10 years because of tightening bank regulation, meaning that strategies holding a lot of corporate bonds, loans, bank hybrids etc. may have difficulty selling their holdings during periods of market stress.

Two added bonuses that are relevant for long term retirement investing would be;

5. Inflation protection

While inflation has been low, it’s far from certain that it remains that way. One of the biggest risks facing those on a fixed income is erosion of purchasing power as inflation rises. For this reason, a strategy that provides returns in excess of inflation is attractive.

6. Tail risk protection

While low correlation to equity markets is a good starting point for a defensive investment strategy, an even better next step is the inclusion of strategies that explicitly account for tail risks i.e. low probability but high impact downside scenarios and have positions that will benefit if those scenarios do occur.

Conclusion

While we had been in a period of abnormally low financial market volatility, this is now changing and therefore, the conventional approach of buying bonds to harvest income may not be as defensive as many retirees assume. In particular, credit securities such as bank hybrids can behave like stable fixed income in normal environments but more like volatile equities on the downside.

It’s now more important to find the right balance of income sources to navigate a range of possible scenarios, including those where unexpected events force you to sell bond holdings and crystalize losses that can be far larger than their income potential.

Tying this together, the ideal alternative defensive income source is one that can deliver positive returns in those scenarios where other income sources struggle, for example if the property market weakened significantly, triggering losses on bank stocks, as well as for bank hybrids and other credit securities.

One such alternative would be an actively traded fixed income strategy that targets positive returns irrespective of the market environment and does so with very low volatility of returns. It should also exhibit low correlation to equities, be highly liquid, and provide protection against both long term inflation risk and short term periods of market stress.

Ardea IM’s Real Outcome Fund aims to deliver these attributes and is therefore a compelling alternative that can complement traditional retirement income sources.

By the Ardea IM Investment Team and Sam Morris, CFA (Investment Specialist at Fidante Partners)