Return Expectations for Active Fixed Income

Bond yields across the major fixed income markets are currently at low levels relative to history. This has caused many investors to question whether the asset class can continue to deliver an attractive return.

Our response to this question is that return expectations should indeed be lowered, but by no more than would be expected given broader economic conditions, and the current point in the cycle.

Market yields are low simply because economic growth is low, and yields are no lower than would be expected for current levels of growth. To expect that the same returns can be achieved from fixed income as were delivered in earlier years and decades would be optimistic. Preparing for a lower range of returns over coming years may therefore be prudent.

While the market beta on offer from fixed income has clearly declined, at the same time the impact of financial regulation and sizeable investor flows is creating a richer set of inefficiencies for active management. These can be used to supplement, and partly offset, the lower returns from market yields alone.

We are therefore recommending that investors lower their guidance for return expectations on fixed income for the coming one to two years. We do not however believe that returns going forward have fallen by as much as the decline in yields: we believe return expectations upwards of 2% above inflation are still attainable.

The role for active, yet defensive, management of fixed income also remains crucial, as the market continues to be in a state of transition, both cyclically and in terms of market dynamics.

Low yields reflect low GDP growth

Earlier swings in yields as part of the business cycle did not alter investor perceptions around the attractiveness of fixed income as a stable, defensive component of a diversified portfolio. We don’t believe the response to this one should be any different.

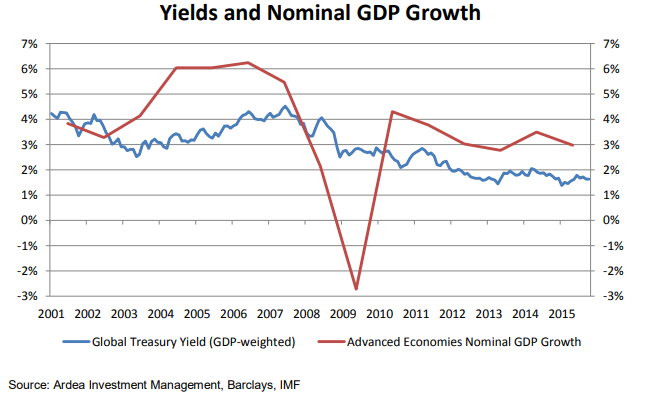

The starting point for return expectations on any asset class must naturally begin with economic growth. In recent years, global GDP growth has remained subdued after what initially seemed like a promising recovery from the global recession. This experience has been accompanied by low yields on government bonds as well. While yields are indeed low compared to historical levels, the chart below illustrates that this is not inconsistent with the prevailing low levels of overall global growth. Nominal yields below nominal growth rates are not unusual, and were the case through the first half of the 2000s as well.

So while the current level of yields may indeed seem unattractive based on historical comparison, current yields do represent fair compensation for the amount of growth being generated in the economy. Looking for higher-yielding alternatives to fixed income may well be fruitless, as the level of broad economic growth needed to support higher investment returns is simply not present. Should the global economy experience higher growth rates in future, then yields would likely increase accordingly, and crucially these higher returns would be underpinned by stronger economic growth.

Tail risk and scenario returns

Heightened volatility across financial markets, and the increasingly binary nature of the outlook, also creates additional benefits for strategies which perform strongly in certain scenarios. Our approach of being long the risks that hurt investors – in particular volatility and inflation – provides a much more diversified exposure than a vanilla allocation alone. The added benefit is extremely strong upside in tail risk scenarios that are damaging for most other asset classes.

Ardea Investment Management