Inflation Linked Bonds 101

Prior to the COVID-19 crisis, inflation was viewed as a tail risk with very low probability. However, with the implementation of extreme Government fiscal stimulus across the globe, inflation is back on the radar. You can read more about it here. In this Market Insight, we explain the mechanics of inflation protection and how to identify relative value opportunities.

Defined benefit and defined contribution superannuation funds, insurance companies and other investors with long term liabilities utilise Inflation Linked Bonds (ILBs) to hedge against both expected and unexpected inflation increases (and decreases). Commodities and equities may provide an inflation hedge over the longer term, however, ILBs exhibit less volatility and provide more certain inflation protection.

As government bonds, ILBs also offer much greater liquidity than most other asset classes. However, as the market for ILBs is smaller than that for nominal bonds, ILBs incur a small liquidity premium relative to nominal government bonds.

Inflation Linked Bonds

In a nutshell, ILBs or as they are also known Capital Indexed Bonds, or Treasury Indexed Bonds protect investors from rising or falling inflation. The formal AOFM definition is:

“Treasury Indexed Bonds are capital-indexed bonds with the capital value of the investment adjusted by reference to movement in the Consumer Price Index (CPI). Coupon Interest Payments will be made quarterly, at a fixed rate, on the adjusted capital value. At maturity, investors will receive the adjusted capital value of the security – the value as adjusted for movement in the CPI over the life of the bond.”

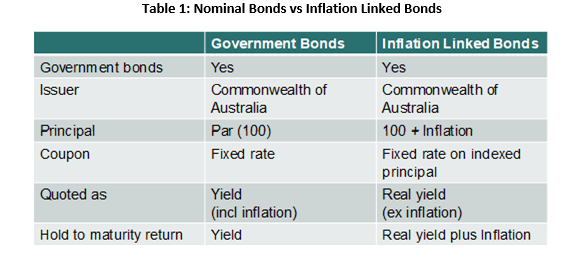

Table 1 provides a summary of the key differences between nominal bonds and ILBs.

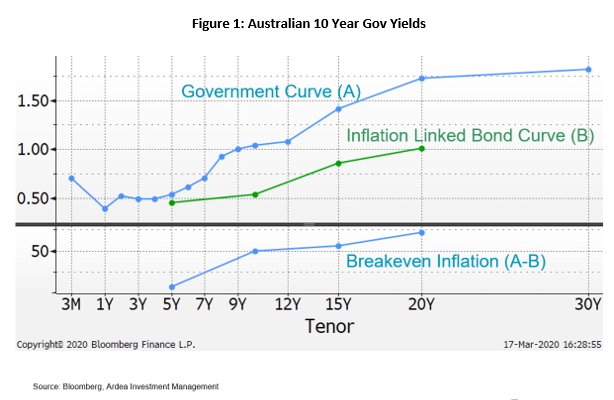

A key metric to measure the relative value of nominal and inflation linked bonds is the Breakeven Inflation (BEI) rate. BEI is the average annual inflation rate at which investors would be indifferent between holding an ILB and a nominal bond. In other words, BEI is the inflation rate which makes the present value of the cash flows of the ILB (discounted by the yield of the nominal bond) equal to the price of the ILB. BEI is thus the market’s expectation for the average annual inflation rate over the life of the bond.A simple method for approximating BEI is to subtract the quoted real yield on the ILB from the nominal yield on a bond with the same maturity and issuer as shown in Figure 1 below.

To be able to compare the relative value of a nominal bond to an ILB with the same maturity we can follow these rules of thumb:

- If BEI is higher than expected inflation, nominal bonds are more attractive than ILBs

- If BEI is lower than expected inflation, ILBs are more attractive than nominal bonds.

Some examples will help to illustrate.

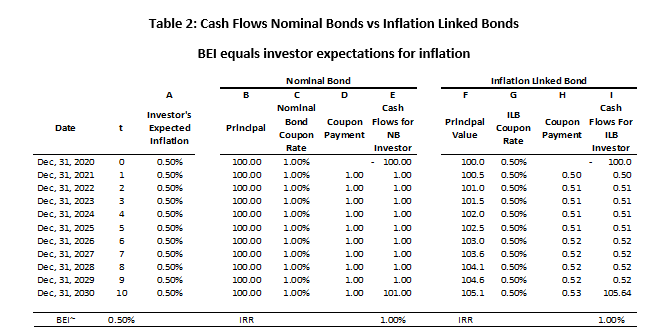

Example 1

Let’s first consider the case where BEI matches the investor’s expectations for inflation over the next 10 years. Suppose the investor was looking to purchase a nominal bond with annual coupon payments of 1.00% or an ILB with annual coupon payments of 0.50%. And so the BEI rate the market is pricing in is approximately 0.5% (1% – 0.5%). The nominal bond will pay the investor a coupon of $1.00 every year and a final payment of $100 at maturity (column E). The ILB will pay the investor a coupon of 0.5% x the principal indexed by inflation each year, and then a final payment of the principal indexed by inflation at maturity (Column I). If the investor’s expectations for inflation over the next 10 years are correct, then the internal rate of return (IRR) for both bonds will be the same (1.00%), and the investor will be indifferent between the two.

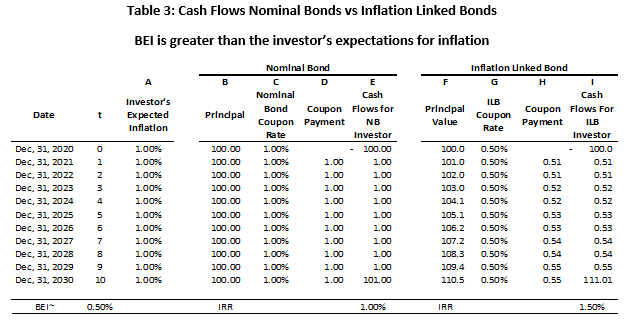

Example 2

Let’s now consider the case where the investor’s expectations for inflation are higher than what the market is pricing in (1% instead of 0.50%). In this case, the cash flows for the ILB are expected to be higher than those in Example 1 (see column I). This means the IRR for the ILB will be higher than the nominal bond and so the investor will prefer the ILB.

Example 3

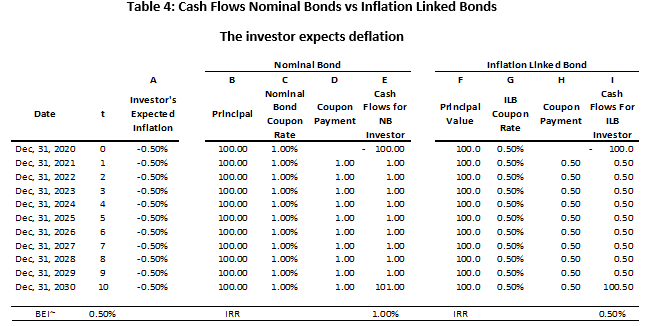

Let’s now consider the case where the investor expects inflation to be negative (-0.5%). If inflation is negative the principal will be adjusted downwards. However, the terms of the bond specify that no coupon payment will be based on a principal value less than the original principal ($100 in this example). If the principal falls below $100, the coupon payment will be made on $100. In effect, coupon and principal payments are calculated with reference to the MAX of (100, [cumulative inflation indexation]).

It is important to note that, both the coupon and principal are protected from deflation, relative to the start of the bond’s life. For example, if inflation is outright negative over the life of the ILB, both the coupon and principal is protected from deflation as shown in the example below. Likewise, if CPI first rose and then declined over the life of the bond, the coupon payments on the bond would rise and then fall, but never to below their starting values (e.g. 0.5% and 100 respectively).

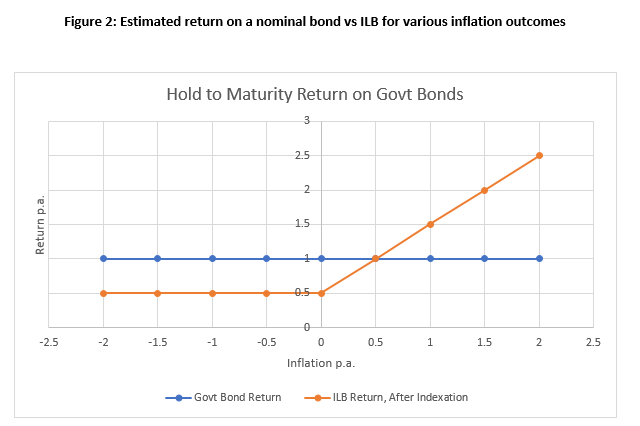

In general, this deflation protection when Inflation is close to zero is much like the payoff from a put. The chart below shows the estimated return on a nominal bond with a coupon of 1.0% and the estimated return on an ILB with a coupon of 0.5% for various inflation outcomes. As described in table 1, the estimated return on the nominal bond is roughly equal to the yield if the investor holds the bond to maturity. The estimated return on the ILB for inflation outcomes below zero is equal to the yield on the ILB if the investor holds the bond to maturity. For inflation outcomes above zero the estimated return is equal to the coupon rate on the ILB plus inflation.

We can see that even though the coupon on the ILB is still paid despite deflation, and thus income is always preserved, for inflation outcomes of less than BEI, the nominal bond outperforms the ILB. If inflation is greater than BEI, the ILB outperforms the nominal bond. Crucially, ILB underperformance during deflation is capped, whereas ILB outperformance increases as a function of inflation.

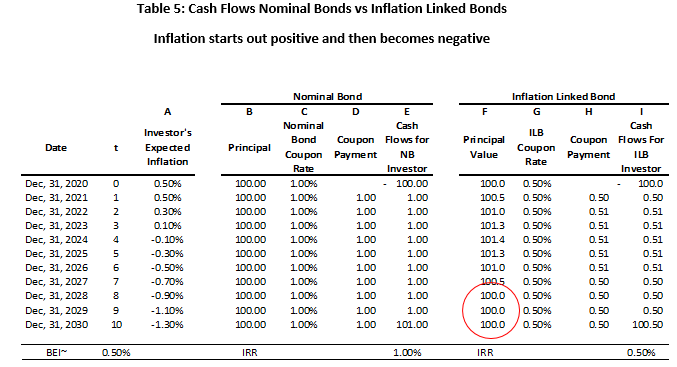

However, it is important to note that if inflation is positive early on, and then negative later (column A), the protection only kicks in once the level of prices fall below the starting level (highlighted in red in column F of the table below).

It is also important to note that these examples all assume that the investor holds the bond until maturity and purchased the bond when it was issued. Returns will necessarily be different if the investor doesn’t hold the bond until maturity or purchases the bond some time after it was issued.

Current Pricing of Nominals vs ILBs

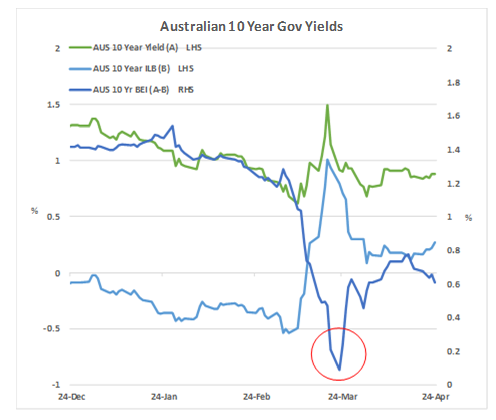

Turning to the question of nominals vs ILBs currently, ILBs are undoubtedly extremely cheap at present. Peak cheapness was achieved a few weeks back when real yields rose to such a large extent that their levels were just below nominal yields. This meant that breakeven inflation rates dipped briefly to near zero. Clearly, buying ILBs with near zero inflation priced in is highly attractive, as any inflation upside from that point onwards translates directly to ILB outperformance on a one-for-one basis.

It’s also our view that actual inflation outcomes, when they approach near zero, become highly resistant to falling further, to below zero levels. History has shown that it’s very difficult to deliver inflation below zero on an ongoing basis. Even Japan managed only a few short bouts of this, and that was with very challenging demographics and multiple policy missteps. Australia should fare considerably better, so this gives us greater confidence to be a strong buyer of ILBs when breakevens are within the broad vicinity of zero, as they still are currently.

Current levels are marginally less attractive than a few weeks ago, but with 10y breakevens still around 60-70bps, we are still looking at pricing that is heavily biased to the cheap side given the reluctance of most market participants to hold inflation protection as they believe that it won’t be necessary. We would take a different view however and note that it’s attractive on a relative value basis, as pricing doesn’t reflect likely fundamentals going forward, and especially once markets stabilise further.

We would also take the view that ILBs are likely to outperform on a medium term basis as well. This is because the ramp up in issuance and elevated government debt levels globally means that it is preferable to hold long term fixed income exposure in inflation protected form, rather than not. So there are good medium term reasons to like ILBs as well.

It should be noted that both nominal bonds and ILBs contain a large amount of duration, particularly for the longer term bonds in these asset classes. This duration is present, regardless of whether you hold nominals or ILBs. Yes, the duration of the universe of ILBs is a touch longer, but this is not likely to hold in future given the lengthening nominal universe, and in any case the duration differences are no longer large enough to materially alter performance depending on whether you are in nominals or ILBs. So if an investor’s asset allocation includes exposure to duration, given the very low BEI rates currently being priced in by the market, we believe the investor should favour holding duration in ILB form rather than nominal form.

This material has been prepared by Ardea Investment Management Pty Limited (Ardea IM) (ABN 50 132 902 722, AFSL 329 828). It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Any projections are based on assumptions which we believe are reasonable, but are subject to change and should not be relied upon. Past performance is not a reliable indicator of future performance. Neither any particular rate of return nor capital invested are guaranteed.