The hidden equity beta in many fixed income funds

The managed fund research company Morningstar recently announced they are splitting their ‘intermediate term bond’ category into two new categories – ‘intermediate core bond’ and ‘intermediate core plus’ bond.

They say they are doing this to provide investors “… clearer expectations for risk and performance”.

Morningstar notes the previous single bond category contained funds that invested in a diverse range of fixed income securities, with levels of credit risk ranging from minimal (i.e. US govt. bonds) to modest (i.e. investment grade corporate bonds) to material (i.e. high yield and emerging market bonds).

They further acknowledge that funds with larger positions in the more credit risk sensitive bonds, such as high yield and emerging markets, can behave very differently in different market environments.

For example, the ‘core plus’ bond category, which includes bonds with greater credit risk, have generally outperformed over the past 10 years because this period covers the post 2008 financial crisis bull market in credit. However, they have also tended to be heavily correlated to equity markets, which caused them to underperform in the fourth quarter of 2018 as equities fell.

Morningstar’s decision relates directly to two themes we have discussed recently;

1. ‘Credit Creep’ In Fixed Income Portfolios

Since 2009, credit investments have been a favourite sub-asset class within fixed income for yield hungry investors. As a result, we’ve noticed a ‘credit creep’ phenomenon whereby fixed income funds have consistently increased allocations to credit investments in search of higher yields.

2. Latent Equity Beta In Corporate Bonds

When interest rates and bond yields get very low, the equity beta inherent in corporate bonds increases. This means even high quality investment grade corporate bonds that are commonly perceived as being defensive, can become highly correlated to equities when equity markets incur losses. (Refer – low yields increase the equity beta of credit investments)

More generally, in the ‘Diversified Fixed Income’ (DFI) category used by many investors, the latent exposure to equity beta can be high because of they can include material allocations to bonds with credit risk.

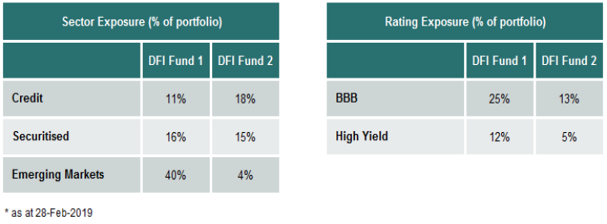

For example, below are the portfolio allocations of two popular Australian DFI funds;

In fact, this persistent credit overweight may actually be THE dominant driver of DFI fund performance, as this research paper pointed out;

“We find remarkably consistent results across categories: a large portion of active FI manager returns can be explained by exposure to credit markets …

It does not necessarily imply that active FI mangers are buying HY corporate bonds en-masse. But it does suggest whatever it is they are doing (carry trades, overweighting securitized assets that embed credit risk, etc.) ends up providing the investor with something that resembles – and is highly correlated with – HY exposure.

This is hardly comforting for an investment into an asset class that is meant to provide diversification from equity markets”AQR, “The Illusion of Active Fixed Income Diversification” 4Q17

While these credit exposures have historically driven higher returns, they come at the cost of introducing equity beta into these portfolios, which compromises their diversification and downside protection benefits in adverse market environments.

This trade-off has become more important in the current environment because low yields make corporate bonds even more sensitive to equity market weakness.

We find that investors are generally aware of the equity beta inherent in pure credit investments such as high yield bonds and loans, but are often surprised at the extent to which it also exists in DFI portfolios, which are widely labelled as ‘defensive’ allocations within broader investment portfolios.

For portfolios that already have material equity holdings, adding the credit exposure inherent in DFI investments could actually result in doubling up rather than diversifying risk when equities fall, which is why it’s important to look beyond labels.

Credit investments generally and the allocation to corporate bonds in DFI funds specifically, are neither inherently good nor bad.

What matters more for achieving risk diversification is considering how these exposures will behave in different scenarios, how those behaviours can change in varying market environments and how they will interact with other assets in the portfolio.

This precisely why Morningstar made the change it did.