Slow growth and low interest rates have become the consensus view

After fears of rising interest rates and bond market volatility rocked global financial markets last year, the consensus is now swinging back to the low economic growth / low interest rates narrative.

We’ve gone from headlines like this last year;

To these kinds of headlines setting the tone this year;

The key catalyst has been the change in tone from the FED.

The global equity market sell-off in the fourth quarter of last year was triggered by fears of the FED tightening monetary policy too aggressively and risking tipping the US economy into recession. However, by January of 2019 they surprised markets by acknowledging the downside risks to economic growth and shifting to a more patient stance on future rate hikes.

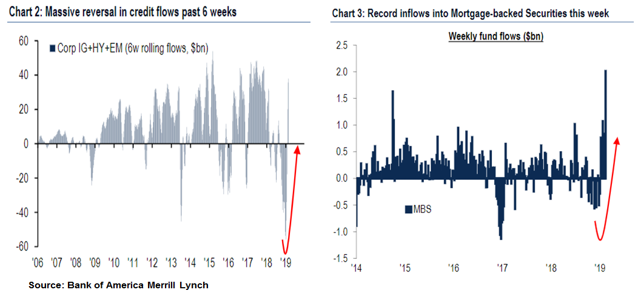

Market pricing and investor positioning have reacted accordingly. Equity and credit markets have had one of the best starts to a year on record, and money has flooded back into rate sensitive sectors like credit, Residential Mortgage Backed Securities, Emerging Markets (EM) and Real Estate Investment Trusts.

Global bond yields have dropped to the low end of the past year’s range and short dated rate markets in Australia and the US are now pricing in rate cuts over the coming years.

Markets are now betting heavily that interest rates are either on hold or going lower and, as this bet is contingent on economic growth remaining sluggish, pro-growth oriented flows into equities have lagged those into yield focused sectors. As Goldman Sachs notes, the year to date (YTD) gap between equity performance and equity fund inflows is one of the largest recorded since the 2008 financial crisis.

Consistent with the slowing global growth narrative, positioning in bond markets has become heavily skewed to lower rates.

For example, in Australia the open interest in 3 year interest rate futures contracts has surged to a record high over the past couple of months as market participants bet on domestic bond yields continuing to fall. In the US, short interest in the iShares long term government bond ETF has dropped to the lowest level in 5 years.

From our experience, whenever a strong consensus develops in one direction, there is a good chance of a surprise and disproportionately large market reaction in the opposite direction. This is why it’s interesting to note a nascent pattern from recent economic indicators suggesting the global economic slowdown may not be as weak or prolonged as the consensus expects.

In China particularly, the power of authorities to stimulate the economy can’t be ignored. Over the past year they have provided monetary stimulus, allowed the currency to depreciate, ramped up fiscal spending, cut taxes and, most importantly, boosted credit growth in a reversal of their previous focus on deleveraging (refer – China risk goes beyond trade wars)

These measures have a time lag before their effects start showing up in economic indicators and in February we saw some early signs that past stimulus may now be starting to filter through, as manufacturing orders rose and new loans rebounded.

We noted last year that markets were slow to focus on China’s economic slowdown (refer – Markets wake up to China risk) and now the potential for surprise is in the other direction … a growth rebound.

In our view it’s impossible to reliably predict or time these kinds of directional changes … remember, it wasn’t so long ago that the crowd was positioned for stronger growth and rising rates. So, our preferred way to position for these kinds of thematic shifts is through interest rate volatility strategies.

When an unexpected change collides into crowded consensus positioning, the result is usually a disproportionally large market reaction and heightened volatility.

We’ve previously covered how these types of strategies can be used to efficiently protect against negative market events (refer – Volatility strategies are reliable risk diversifiers), but they can also be used to position for positive surprises – stronger than expected economic growth for example – because interest rate markets react strongly to these as well.

With market pricing of volatility across global interest rate option markets back down near historically low levels, it’s currently very cheap to take advantage of these favourably asymmetric opportunities.