The early movers are leaving the credit party

“What the wise do in the beginning, fools do in the end”

– Warren Buffet

Coming out of the 2008 financial crisis, large portions of global credit markets offered very attractive risk premia (extra return received for taking on risk) that made credit market exposure a compelling risk vs. reward proposition.

Since then, the reach for yield has driven enormous flows of capital into credit markets and this has been a great trade for investors.

In the beginning of this process the stars were aligned, as credit spreads were wide enough to compensate not just for default risk but also offer generous risk premia on top of that. At the same companies were eager to issue more debt at low interest rates, providing an ample supply of credit assets to satisfy investor demand.

Things have now changed.

There is little risk premia left in many parts of global credit markets, and in some cases not even any base line compensation for default risk. (for details refer to – corporate bonds – more risk for less return)

Back at the early stages of this reach for yield process, credit market exposure was the wise choice. Now that we’re closer to the end, it’s more questionable.

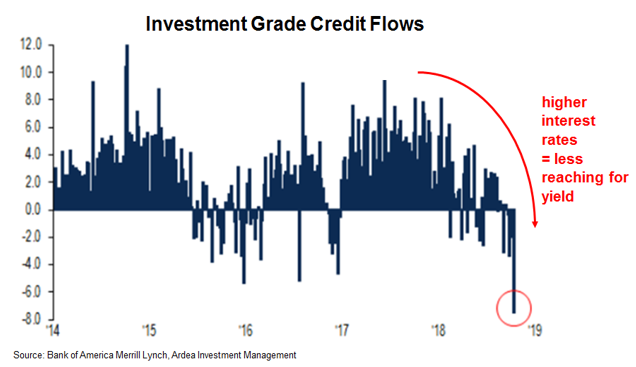

In fact things have now reversed and the early movers are going the other way, resulting in credit inflows turning into outflows, as shown in the chart below for US investment grade credit.

Why is this happening now? After all, default rates are still low and economic growth is decent.

Perhaps, it’s simply that as interest rates are now rising, the desperation to keep reaching for yield into riskier credit assets is no longer there. (for details refer to – investment grade credit relative value , the most important chart you’ve ignored)

Goldman Sachs explains it this way;

“As the rate of return on safe assets rises, the appeal of risky assets falls, and we increasingly worry that rising trend in US real rates vs global rates is “boiling the frog” on risk appetite. An increase in the fragility of risk appetite is already visible in EM, we would argue, but it logically extends to global risk assets more generally.

As the rate of return on cash rises, the appeal of risky assets falls. Rising US real rates – the world’s “safe asset”– are leaving risky assets more vulnerable to otherwise-manageable imperfections in the risk environment.”