Yes inflation is low, but that’s already heavily priced in

Recent inflation readings in Australia and the US have reinforced the strong consensus view that inflation will remain very low for a long time.

In fact, one of the most confounding developments for conventional economic analysis is the persistence of low inflation despite economic growth rebounding following the 2008 financial crisis.

Economic orthodoxy suggests that when economic growth accelerates, inflation should follow, but this hasn’t happened. Possible explanations range from technological change, to demographics and the changing structure of labour markets.

Whatever the reason, the low inflation view has become strongly entrenched … so much so that Bloomberg’s Businessweek magazine ran the following cover story this month;

Jokes about contrarian magazine cover indicators aside1, while the expectation for ongoing low inflation may or may not prove correct, what is clear is that market pricing has also become highly skewed towards the ‘low inflation forever’ scenario.

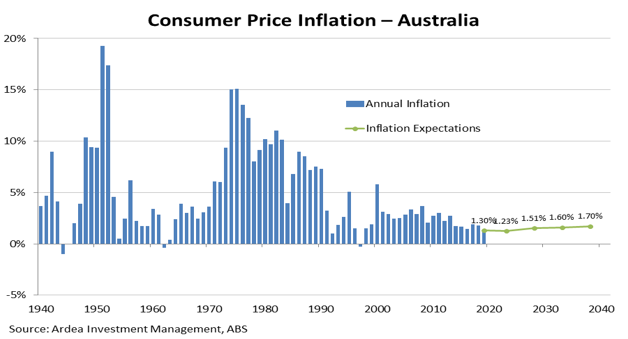

For example, the chart below shows actual historical inflation in Australia (the blue bars), together with future inflation expectations as implied by current market pricing of inflation linked securities (the green line). The flatness of the green line indicates that current market pricing assumes that the low inflation evident today will persist very far into the future.

While no one can reliably predict future inflation, what we do know with certainty is that current market pricing is leaving very little room for the possibility of inflation surprising to the upside in future and the same phenomenon can be seen across most inflation markets globally.

Getting a bit more nuanced, market pricing of inflation (known was ‘breakeven inflation’) can be broken into three sub-components – inflation expectation, inflation risk premium and liquidity premium.

Setting aside liquidity premia, the ‘inflation expectation’ reflects consensus expectations about future inflation, while the ‘inflation risk premium’ reflects compensation to bond investors for the risk that actual future inflation deviates from those expectations.

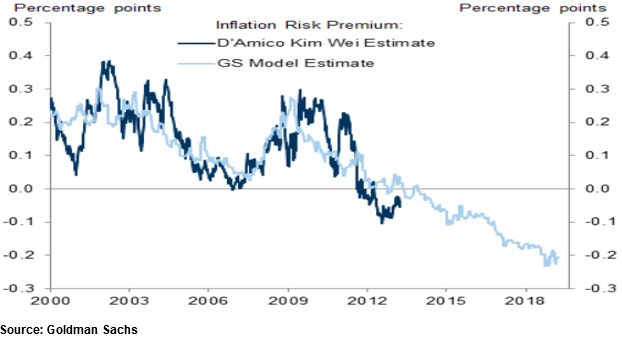

While these sub-components can’t be directly observed, most estimates show that inflation risk premia have fallen significantly since 2009 and by some measures are actually negative now, as shown in the chart below.

One interpretation of a very low inflation risk premium is that current market pricing gives virtually no allowance for the possibility that future inflation turns out to be higher than what is currently expected.

For example, in a recent speech, European Central Bank official Benoit Coeure noted, “… the marked fall in the inflation risk premium suggests that investors assign only a small probability to inflation turning out to be higher than expected.”

So, the current market pricing of long dated inflation securities seems to reflect complacency about the potential for future inflation surprises, just as much as it does the prevailing consensus expectation that inflation will remain low.

As a result, inflation market pricing has become overly skewed to one scenario (i.e. low inflation forever), at the expense of severely under-pricing the possibility of other possible scenarios, perhaps reflecting a behavioural bias for investors to become overly anchored to present conditions. 2

This has much broader relevance beyond bond markets because an upside inflation surprise has the potential to disrupt market perceptions about central bank policy.

The current consensus view is highly confident that central banks won’t hike rates any time soon, and in fact may end up cutting rates to stimulate economic growth. This in turn has been a big driver of the rebound in equity markets following the Q4 2018 sell-off.

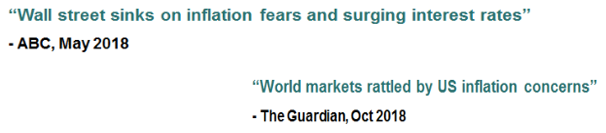

But if even some uncertainty about inflation comes back, that confidence will crumble and central banks will once again become the markets bogeyman, as the fear of inflationary pressures forcing them (the FED in particular) to raise rates will dominate. (Refer – positive asset correlations and inflation assumptions)

It was only a few months ago that this exact scenario played, while the fundamental inflation picture hasn’t changed that much since then.

A ‘relative value’ investment approach offers attractive opportunities to position around this type of risk.

Adopting a more nuanced view of inflation as a multi-dimensional phenomenon that plays out over numerous time horizons, rather than a binary low/high inflation outcome, gives rise to a broader range of return generating opportunities to exploit. (Refer – better ways to position for future inflation surprise)

Additionally, as an inflation surprise would certainly cause a surge in bond market volatility, interest rate options also offer very cheap ways to not only protect against, but actually profit from, a potential repeat of 2018’s market dynamics. (Refer – how to profit from interest rate volatility)

1 Wikipedia – The Magazine cover indicator is a somewhat irreverent economic indicator, though sometimes taken seriously by technical analysts, which says that the cover story on the major business magazines, particularly BusinessWeek, Forbes and Fortune in the United States is often a contrary indicator.

A famous example is a 1979 cover of BusinessWeek titled “The Death of Equities”. The ’70s had been a generally bad decade for the stock market and at the time the article was written the Dow Jones Industrial Average was at 800. However, 1979 roughly marked a turning point, and stocks went on to enjoy a bull market for the better part of two decades.

2 Another interpretation uses the lens of investment portfolio diversification, arguing that negative inflation risk premia reflect a shift in consensus views toward a positive co-variance between inflation and equity market performance.

Prior to the mid 1990’s the co-variance was negative (i.e. inflation linked securities had negative market beta) as inflation shocks were seen as a trigger for recessions and equity market losses. This meant that inflation linked securities had diversification value when added to a broader investment portfolio.

However, post the 2008 financial crisis, the concern has been more about deflationary shocks being associated with economic weakness, in which case the co-variance to equities becomes positive and inflation linked securities lose their diversification value. In this paradigm, investors prefer nominal bonds as they offer better diversification value, which places downward pressure on breakeven inflation and supports a very low inflation risk premium.