Vanishing yield cushions and the asymmetry of duration risk

It is widely assumed that government bonds are inherently ‘safe’ investments and that they provide defensive risk diversification benefits when included in multi-asset investment portfolios.

Looking backward, we can point to historical episodes where these assumptions have indeed held up well. But looking forward, these assumptions are no longer so reliable.

We’re now in an environment that poses challenges for conventional bond investments because ultra-low interest rates and bond yields fundamentally change the risk vs. return proposition of bonds and challenge conventional assumptions about the defensive role they are supposed to play in multi-asset portfolios.

Low bond yields mean small yield cushions, which directly reduces the defensive benefits of conventional bond investments. They also make the forward-looking risk vs return profile of bonds unfavourably asymmetric.

While there is still a role for government bond beta exposure (i.e. duration) in multi-asset portfolios, particularly because it’s easy to understand and cheap to implement, it is a blunt instrument that works best when the starting point of bond yields is reasonably high.

Given we’re in precisely the opposite environment right now, multi-asset portfolios need to recognise that it is sub-optimal to be overly reliant on duration for portfolio diversification and downside protection.

(Please note, the ideas in this article are less relevant for special use cases of duration such as matching liabilities.)

Vanishing yield cushions

Conventional approaches to bond investing rely on accumulating portfolios of bonds to harvest yield. The flip side of yield is interest rate duration risk, which is the primary risk inherent in high quality government bond investments. (A refresher on bond yields and duration risk is available here)

A common approach is to think about bond yields as a cushion that protects bond investors from the potential negative effects of duration risk. The yield cushion helps mitigate losses from falling bond prices if yields were to rise.

Additionally, bonds are most commonly used in multi-asset portfolios to play a specific defensive risk diversification role. Basically, as something that can do well if equities fall, thereby helping reduce total portfolio level drawdown risk.

This is the central diversification assumption that conventional portfolio construction relies on. The idea is that when equities fall, bond yields decline, resulting in capital gains on bond holdings that help offset equity losses. (The correlation between bond and equity prices is discussed in more detail here.)

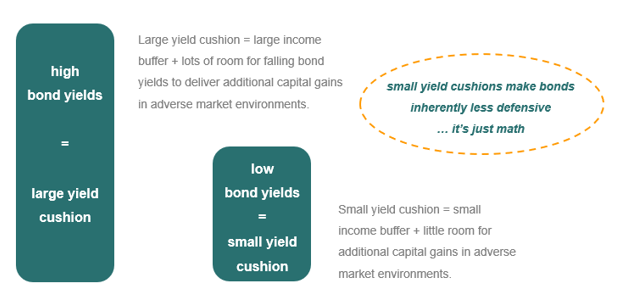

In this context, we can think of the stable income provided by bonds, together with the potential for declining bond yields to deliver additional capital gains in adverse market environments, as a yield cushion that helps offsets losses on equities and other risky assets in adverse scenarios.

For conventional bond investments, the size of the yield cushion is a key determinant of how well they can play their defensive risk diversification role.

High bond yields translate to large yield cushions, which allow bonds to play their defensive role well. But when bond yields are low, as they are today, bonds deliver less income and become inherently less defensive as yield cushions shrink.

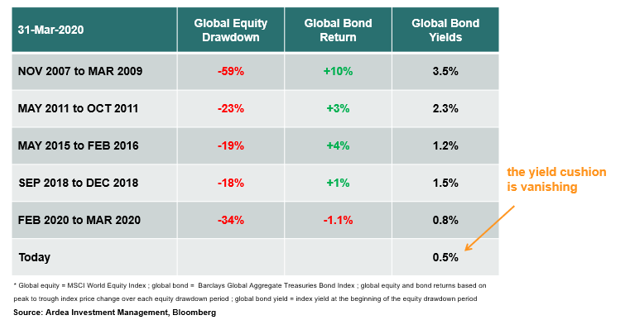

As an example, heading into the 2008 financial crisis interest rates and bond yields were a lot higher than they are today. Yield cushions were therefore large and bonds were able to deliver a decent income buffer, together with large capital gains as interest rates / bond yields declined as equities fell … that was the yield cushion in action.

However, as the table below shows, over subsequent equity drawdown periods the defensive protection provided by conventional bond investments progressively decreased as yield cushions shrank.

Today, those yield cushions are fast approaching zero.

Looking back prior to the Q1 2020 virus turmoil, collapsing global bond yields, turbocharged by extreme monetary policy easing, delivered large windfall capital gains to any bond portfolio with duration exposure (details here). Unusually, this happened over a period in which equities reached all-time record highs. This was a dream scenario for multi-asset portfolios because the return seeking equity side of portfolios, as well as the defensive bond side, both experienced a highly correlated rally. But that came at the cost of vanishing yield cushions.

As such, looking forward the picture is very different. With yield cushions vanishing and yields now close to effective lower bounds, there is no room left for bonds to repeat those historical windfall gains unless you believe bond yields can push deeply negative.

The implication for multi-asset portfolios is that vanishing yield cushions have compromised the ability of conventional bond investments to play their defensive risk diversification role.

The asymmetry of interest rate duration risk

With government bond yields fast approaching zero, vanishing yield cushions have left conventional bond investments with a forward-looking risk vs return profile that is unfavourably asymmetric.

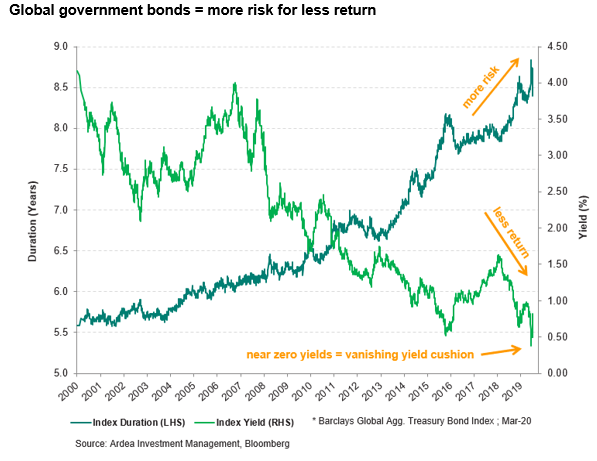

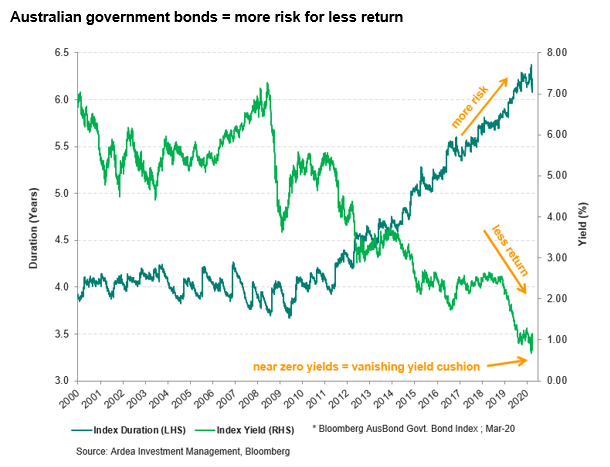

As bond yields represent the compensation that investors receive for bearing interest rate duration risk, we can look to the duration vs. yield trade-off as a good indicator of how attractive (or not) the risk vs. return proposition is.

For example, the charts below show the duration vs. yield trade-off for global and Australian government bond indices that are referenced by conventional duration based fixed income funds. In both cases yields have collapsed to near zero, meaning very low expected returns going forward. While at the same time, duration risk has increased, meaning greater risk of capital losses if yields were to rise. Therefore investors are left facing more interest rate risk for less return.

Of course, duration risk works both ways. If bond yields fall a lot, duration exposure can deliver large capital gains, which is exactly what had been happening across global bond markets throughout 2019. (details here)

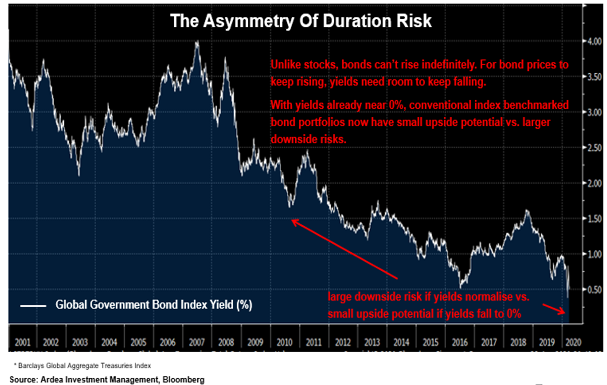

But with bond index yields already close to zero, the duration exposure inherent in conventional index benchmarked bond portfolios has become unfavourably asymmetric i.e. the future loss potential has become disproportionally large relative to the remaining upside.

The chart below puts this asymmetry into context for just one global government bond index, but the same dynamics are playing out universally.

Over the 12 months to 31st March, this index delivered a return of 5.8% as bond yields collapsed toward zero. To repeat this performance, the index yield would need to go negative, which is theoretically possible but certainly an extreme scenario. However, if yields were to normalise even modestly toward recent averages, the index wold incur large losses.

This is the same type of asymmetry that any conventional duration-based bond portfolio is currently faced with and because of this, the lower that yields go the more vulnerable investors become to future losses. This brings to mind the ubiquitous but frequently ignored disclaimer that past performance is not indicative of future returns.

An unavoidable reality is that bond prices can’t keep going higher unless yields keep going lower, which is why, unlike with equities, the upside potential in bonds is inherently capped.

Even if stocks are expensive, there is no real limit to how high they can go. Bond prices on the other hand are bounded by the fact that hold-to-maturity returns are limited to interest payments received over the life of the bond. Any additional capital gains before then are limited by how low yields can go.

This unfavourable asymmetry of risk vs return is inescapable as bond yields keep going lower because when the starting point of yields is already extremely low to begin with, there is naturally less room for them to drop further. This is what makes chasing bonds at record low yields (i.e. record high prices) very different to chasing stocks at high valuations. Stocks can keep going up indefinitely. Bonds can’t.

As the experience of Japan and Europe shows, there is strong resistance to bond index yields going far below zero, because a hold-to-maturity investor buying bonds with negative yields would be locking in a guaranteed loss.

Additionally, there is a growing consensus view that the unintended adverse side effects of central banks cutting rates below zero outweighs any potential benefits, as explained in this article about Sweden’s decision to end its negative interest rate experiment:

“This is also the most explicit signal yet of growing concerns in Europe about the collateral damage and unintended consequences of protracted and excessive reliance on unconventional monetary measures, particularly negative interest rates and large-scale purchases of securities.

The loud Riksbank message to other central banks is that being “the only game in town” for too long can make them not just ineffective but also counterproductive.

If Sweden can hold out as the monetary policy outlier in Europe — and it’s far from easy given the “small country” conditions — this could well be looked back at as the beginning of the end of a historic policy experiment, one that worked initially but was subsequently undermined by the failure of politicians to enable the much-needed pivot to a more comprehensive pro-growth policy response.”

– Bloomberg News, ‘Sweden says enough is enough on negative rates’, Dec 2019

We can think of ultra-low bond yields as pushing against an elastic band that sits at the zero-yield level. Yes, yields can push below zero but as they do, that elastic bands gets stretched further and further, raising the risk of a snap back at some point.

On this point, with policy makers announcing unprecedented global fiscal stimulus coordinated with ultra-loose monetary policy, we can see a growing number of tail risks that could indeed cause a spike higher in government bond yields. Such scenarios may have us looking back in disbelief at the current period of sub-1% long duration government bond yields. (details here)

Given the complex web of variables and feedback loops that drive bond yields, nobody can reliably predict which way bond yields will head from here. Even the bond kings and macro gods struggle to consistently get these types of directional market right.

While the future direction of bond yields is uncertain, what’s clearly visible right now is that the risk vs return profile of conventional duration-based bond investments has become unfavourably asymmetric.

Implications for portfolio construction

Conventional high-quality government bond investments are widely assumed to be ‘safe’ investments, and in terms of credit default risk that assumption does hold. However, they are no longer ‘safe’ in terms of the risk of near-term capital losses stemming from the unfavourable asymmetry of duration risk.

Investors rushing to the perceived safety of government bonds, have careened headlong into the poorly compensated and treacherous territory of interest rate risk. As equity investors know well, the price at which you buy matters as much as what you buy. Government bonds are not immune from losses if you buy at too high a price and that’s doubly true when faced with such unfavourable asymmetry.

In the absence of any directional view on bond yields, duration exposure is often held solely as a defensive risk diversifier to protect against downside equity risks. But even in this use case, vanishing yield cushions have compromised the ability of conventional bond investments to play their assumed defensive risk diversification role.

The conclusions here are not binary. It’s not about which way bond yields will move from here or whether duration exposure should be excluded from portfolios entirely.

For multi-asset portfolios, it’s about a nuanced re-assessment of how government bonds are expected to behave, an objective scrutiny of how reliably duration exposure can continue to play its defensive role and balanced consideration of the tail-risk scenarios that might play out because of the unprecedented fiscal and monetary policy actions currently being implemented.

The vanishing yield cushion fundamentally changes the risk vs. reward proposition of bonds and challenges conventional assumptions about the diversification value of including conventional duration based bond investments in multi-asset portfolios.

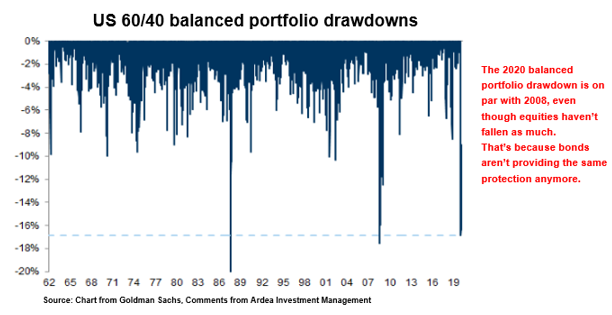

We have now experienced two large equity drawdown episodes (Q4 2018 and Q1 2020) where conventional duration exposure failed to reliably protect multi-asset portfolios.

These are not temporary blips, they are a paradigm shift driven by vanishing yield cushions and the increasingly unfavourable asymmetry of duration risk.

They should be heeded as warning signs that conventional assumptions about portfolio construction and risk diversification may no longer be reliable and that it is a bad idea to simply assume that bonds will continue behaving as they have in the past.

“For much of the past century, the building blocks of most investment portfolios have been a combination of riskier stocks and steadier, safer bonds. Like a see-saw, one typically rises if the other falls, smoothing returns and offering a hedge.

But over the past decade, this relationship has broken down. Bond yields have sagged as their prices have risen alongside equities, producing healthy gains but limiting how much protection bonds can offer in downturns. The recent market chaos unleashed by the coronavirus pandemic has underscored the problem, with bruising trading periods in which bonds and equities have dropped in unison.”

– Financial Times, ‘Market ructions test faith in classic portfolio mix’, April 2020

“A 60/40 portfolio had one of the largest drawdowns since the 1960s this month. This was due to the sharp equity drawdown but also as there was less of a buffer and diversification from bonds.

… In addition to the sharper-than-normal equity correction, diversification in 60/40 portfolios has been less good. First, with bond yields at all-time lows now and close to the effective lower bound, there is little space for most DM bonds to buffer equity drawdowns. In other words, the beta of bonds to equities has declined, especially in Europe and Japan. But also equity-bond correlations turned positive in most markets”

– Goldman Sachs, ‘The 60/40 Drawdown and Multi-Asset Portfolio Risk’, Mar 2020

While there is still a role for government bond beta exposure (i.e. duration) in multi-asset portfolios, particularly because it’s easy to understand and cheap to implement, it is a blunt instrument that works best when the starting point of bond yields is reasonably high.

Given we’re in precisely the opposite environment right now, multi-asset portfolios need to recognise that it is sub-optimal to be overly reliant on duration for portfolio diversification and downside protection.

Access to a cheap beta exposure like duration can be attractive when that beta exposure offers an attractive risk vs. return proposition and can reliably play a portfolio role. Failing that it can be a false economy.

It’s time to look beyond the conventional duration lever to lesser known but increasingly compelling alternatives for defensive risk diversification. These can help fill the gap in scenarios where duration doesn’t work as well as hoped.

This material has been prepared by Ardea Investment Management Pty Limited (Ardea IM) (ABN 50 132 902 722, AFSL 329 828). It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Any projections are based on assumptions which we believe are reasonable, but are subject to change and should not be relied upon. Past performance is not a reliable indicator of future performance. Neither any particular rate of return nor capital invested are guaranteed.