The push and pull on bond yields

2019’s rampant bond rally came to a halt this month as bond yields rose, causing bond prices to fall across most major bond markets.

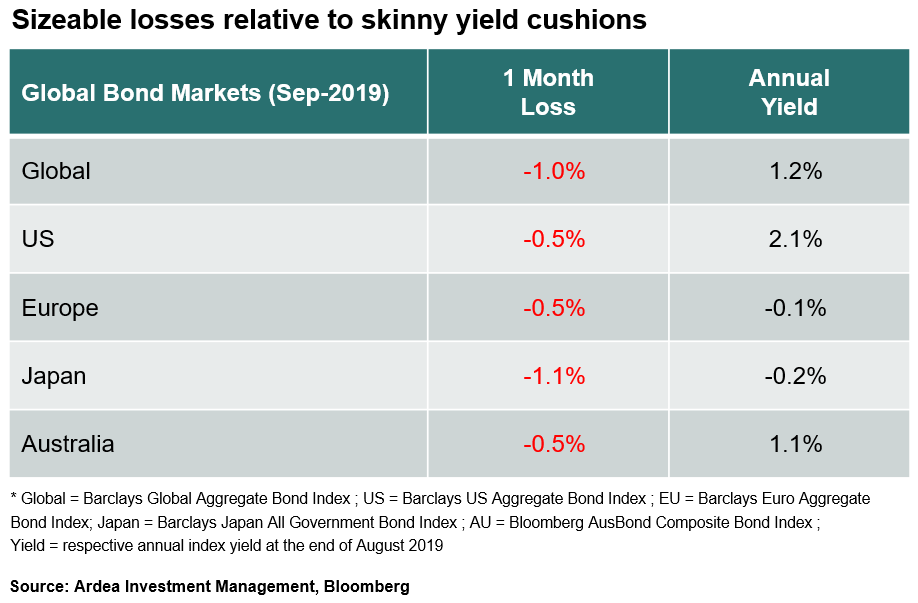

For example, the mostly widely followed global bond index – Barclays Global Aggregate Bond Index – lost 1% in September, which is sizeable given it nearly wipes out a whole year’s worth of yield.

While all these bond markets are still sitting on very healthy 12-month gains from prior yield declines, the table above highlights how quickly those gains can vanish when yields reverse and also how the risk vs. return proposition of conventional yield-based bond portfolios changes when yield cushions are very small. (details here)

For those focused on trying to predict market direction, forecasting which way bond yields will go from here, and by extension whether conventional bond holdings will extend September’s losses, is no easy task.

There are a range of competing factors that could either keep pulling bond yields higher from here or just as easily revert to pushing them back down again.

Some of the factors that could keep pulling bond yields higher include:

- US economy turns out better than feared

Consensus views are already heavily skewed to a negative outlook for the US economy, which in turn is driving expectations for lower US interest rates and bond yields. Given the importance of the US economy to the world, this in turn has been a driver of lower bond yields globally.To the extent that the US economic trajectory turns out better than the current negative consensus, those expectations for lower rates / yields need to be revised.

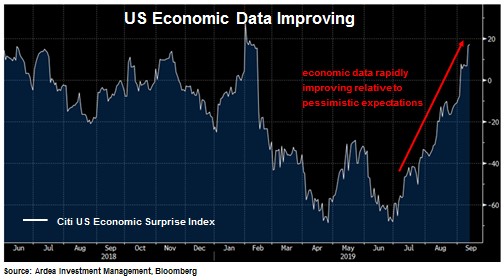

On this point, the chart below shows the US Economic Surprise Index produced by Citigroup. It tracks how actual economic data releases compare to the consensus expectations of economists that are recorded prior to the data releases. A string of better than expected economic data releases has now pushed the index back above zero, meaning economic data is on average exceeding expectations.

Within the sub-components of the index, particularly noteworthy is rising inflation, with the latest reading for core CPI reaching the highest level since the 2008 financial crisis. We have noted before that markets are heavily positioned for inflation to remain very low for a very long time (details here) and that any upside surprise could become destabilising for both bond and equity markets at the same time (details here)

Within the sub-components of the index, particularly noteworthy is rising inflation, with the latest reading for core CPI reaching the highest level since the 2008 financial crisis. We have noted before that markets are heavily positioned for inflation to remain very low for a very long time (details here) and that any upside surprise could become destabilising for both bond and equity markets at the same time (details here) - US vs. China trade war resolution

The damaging impact of trade tariffs and the uncertainty created by the ongoing news headline ping-pong on trade war negotiations is taking a heavy toll on business sentiment, which in turn is feeding negative global economic growth expectations.Any favourable progress on this front would reverse these expectations, forcing bond yields higher.

- More pushback on the wisdom of ultra-low rates

The chorus questioning the wisdom of ongoing interest rate cuts is getting louder, particularly in economies where rates are already negative. The scrutiny around whether the benefits of ultra-low rates in stimulating economic growth justify the unintended side effects is increasing and the conclusions don’t appear favourable for those in the ‘low rates = stronger economic growth’ camp. (details here)If the consensus really does swing to the view that continuing to cut rates when they’re already very low is pointless at best and creates very damaging side effects at worst, current market expectations of low rates forever would need to be substantially revised, forcing bond yields higher.

On this point, two events this month are worth noting.

Firstly, a European Central Bank (ECB) board member unexpectedly resigned in seeming protest against the ECB’s ongoing rate cut policy. Bloomberg news described it as “… a shock move in the wake of unprecedented dissent over President Mario Draghi’s latest stimulus drive.”

Secondly, one of the US Federal Reserve board members, who had been considered a ‘dove’ (i.e. favouring rate cuts), surprisingly stated this month that he does not see the need to cut interest rates any further.

- Buying duration is a crowded trade

Record inflows to bond funds this year and market pricing that is already heavily skewed to rate cuts suggest that lots of investors are buying bonds in the hope that their inherent interest rate duration exposure will deliver capital gains as yields keep falling. That has made the ‘long duration’ trade a very crowded one.Just because a trade is crowded, doesn’t mean it’s wrong. However, history does tell us that when strong consensus expectations and crowded positions build up, the room for disappointment grows and a potentially violent re-pricing can follow if things don’t play out as expected.

A good indicator of the extent to which markets are already positioned for lower rates was the reaction to new stimulus measured announced by the ECB earlier this month (including cutting rates further to negative 0.5% and extending their program of bond purchases – i.e. quantitative easing). Previously this would have triggered another leg lower in bond yields, further fuelling this year’s epic global bond market rally but instead, bond yields actually rose.

On the surface it seems paradoxical that bond yields rose in response to rate cuts. Reading deeper, the post-ECB bond market sell-off shows how skewed bond market expectations are toward aggressive rate cuts / ongoing central bank stimulus and how crowded positioning around the ‘long duration’ theme has become … the crowd thinks interest rates can only go lower and has been piling into conventional duration based bond investments at record pace (details here, and here).

With expectations already running so high, central banks need to deliver a lot just to keep pace. So even if central banks don’t raise rates, the potential for bond yields to spike higher remains.

Some of the factors that could push bond yields back down include:

- Global economic growth does turn out to be bad

This is effectively the base case that bond bulls are betting on and there are clear signs in some places (e.g. China, Europe) that economic momentum is indeed slowing materially. For example, hard data and sentiment-based readings on the global manufacturing sector have been consistently poor and if anything, seem to be getting worse.Additionally, if US-China trade tensions continue or escalate, the economic damage will likely increase.

- Race to the bottom in FX

One of the side effects of changing interest rates is the impact on an economy’s currency, which in turn impacts the competitiveness of its export sector. So, to the extent that central banks are forced into a competitive currency devaluation fight to maintain the competitiveness of their own export sectors, yields could keep going lower. - The central bank bar tab

Since the 2008 financial crisis, markets have become conditioned to a dynamic whereby, at the slightest hint of economic weakness or market volatility, central banks are quick to jump in with monetary stimulus.We’ve highlighted previously that the resulting combination of abnormally low interest rates and quantitative easing was akin to the bar tab that had kept the markets party going in the post financial crisis era and that it had clouded investor judgement on risk and asset pricing … near zero interest rates can make any asset look attractive. (details here)

As investors now increasingly anticipate that familiar pattern of pre-emptive rate cuts to keep asset prices supported, by extension a belief takes hold that bond yields have to keep going lower (or at least can’t rise much) because the central bank bar tab is always open. After all, bond yields can’t rise much if central banks are constantly cutting rates and buying more bonds.

On this point, Japan provides a good example of what happens when belief in the central bank bar tab is tested. This month Japanese government bonds experienced their worst monthly performance in years as the Bank of Japan (BOJ) announced it could scale back its bond purchases.

The prospect of the BOJ reducing its bar tab has forced investors to consider whether the Japanese bond market party can continue, particularly given that negative Japanese bond yields make the price of entry to that party very steep.

These are just a few of the factors one needs to consider in predicting which way yields will go from here. There are in fact many more, such as geopolitical risks, funding market dynamics etc. that all feed into the complex web of variables and feedback loops that drive bond yields.

While there’s no shortage of strongly expressed opinions from the expert forecasters, we struggle to see how anyone can have high conviction about such a blunt directional market call in the face of all these uncertainties. Even the bond kings and macro gods struggle to get these calls consistently right.

Remember, it was only last year that the forecasting crowd was convinced rates would only go up, and now that same crowd is equally convinced of the exact opposite view.

Whichever way you think bond yields will go from here, one thing that’s inescapable is the growing asymmetry of duration risk. (details here)