There’s more to fixed income than just buying bonds

As ultra-low yields have left conventional bond investments facing more risk for less return, pure ‘relative value’ investing offers a lesser known but increasingly compelling alternative for those seeking consistent low volatility returns, irrespective of the level of yields or broader market fluctuations.

Conventional fixed income portfolios are largely based on buying bonds to harvest yield. In return for that yield, they are exposed to some combination of the three common risks inherent in bonds, as shown below.

Active managers may also profit from bond price movements to generate additional returns. They do this by varying the portfolio’s exposure to these common risk factors, based on their market forecasts. For example, by increasing interest rate risk exposure based on a forecast for lower bond yields they may profit from higher bond prices, assuming their forecast turns out to be right.

These conventional fixed income return drivers and risk factors are discussed in more detail here.

The challenges facing conventional fixed income investments

The conventional yield-based approach to fixed income investing does have benefits. It is familiar, readily accessible and easy to understand. However, the downside is that when bond yields are very low, this approach can get stuck with low returns and is also vulnerable to capital losses if interest rates or credit spreads rise.

Additionally, while yield is the source of return, it is also the compensation for taking risk. Bond yields therefore act as a cushion to protect investors from the risk of bond prices falling due to the combination of interest rate, credit and liquidity risks they are exposed to. Hence when yields are very low, this protective yield cushion shrinks, leaving conventional bond investments exposed to more risk for less return. (details here)

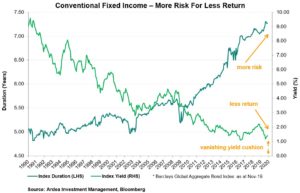

The chart below shows the yield and duration (a measure of interest rate risk) of the most widely referenced global bond index used by conventional fixed income funds and the following features stand out:

- The current level of bond yields is not only very low relative to history but also approaching zero in absolute terms.

- The interest rate risk exposure (i.e. duration) has consistently increased.

- The yield cushion is vanishing.

To escape this low yield morass, conventional fixed income approaches only have three options to increase returns – take more interest rate risk or credit risk or liquidity risk. The consideration then becomes whether the risks being taken are adequately compensated and how those risks might impact future performance in different market environments.

In our view, none of these three options are particularly appealing at the moment because:

- As yields approach zero, the risk vs. return trade-off from taking more interest rate risk becomes asymmetrically poor. (details here)

- Compensation for taking more credit risk is currently low (details here) and credit investments carry latent equity beta, which compromises the defensiveness of a fixed income portfolio. (details here)

- Taking more liquidity risk can be inconsistent with the objectives of a defensive fixed income investment. (details here)

A further consideration is that when bond yields are very low, bond price fluctuations can become a more dominant return driver than yield. This means the outlook for future returns becomes less about the current yield and more about correctly predicting the future direction of bond prices (details here). As the latter is driven by a complex web of variables and feedback loops, we have yet to come across anyone who gets these types of directional market calls consistently right. Even the bond kings and macro gods struggle.

Pure relative value investing is a compelling alternative

A lesser known but nonetheless long-standing approach to fixed income is pure ‘relative value’ (RV) investing.

Pure RV investing does not rely on conventional fixed income return sources and is therefore unaffected by whether bond yields are high, low or even negative. Nor is it reliant on credit risk or trying to predict direction of interest rates. Instead, a pure RV approach focuses on pricing inconsistencies between closely related securities.

Global interest rate markets offer a huge diversity of securities, such as government bonds, that are explicitly linked to each other by well-defined relationships. In a theoretically efficient market, these securities would always be consistently priced with one another. In reality, we continually observe pricing inconsistencies between closely related securities that have very similar risk characteristics.

These pricing inconsistencies – known as RV mispricing – can be isolated using a wide range of risk management tools, such as interest rate derivatives, which strip out unwanted market risk in order to profit irrespective of the level of yields or direction of interest rates.

Pure RV opportunities exist because fixed income markets are inefficient. Underlying structural factors like regulation, investor mandate restrictions, and varying investor objectives cause market participants to transact for reasons other than profit maximisation. The diverse range of buying and selling flows that result cause temporary demand / supply imbalances, resulting in RV mispricing.

Examples include banks managing their balance sheets, insurance companies hedging liabilities, passive investors tracking benchmarks, governments financing deficits and central banks pursuing policy objectives.

Market inefficiency has proven to be pervasive across global fixed income markets and persistent through market cycles because the underlying drivers are structural in nature. From our experience, this is what makes RV mispricing a reliable source of returns, around which a repeatable investment process can be built.

Furthermore, the opportunity set is growing because the banks that used to dominate the RV space have become increasingly constrained. (details here)

Unlike conventional fixed income investments, which may be stuck with low returns when yields are low, and may also incur capital losses if rates rise, a pure RV investing approach can generate returns that are independent of the level of yields or direction of interest rates, while exhibiting minimal correlation to broader market fluctuations.

There is a lot more to fixed income than just buying bonds and a pure RV approach opens up this broader range of return sources, beyond the conventional.

Conventional relative value analysis vs. pure relative value investing

Many active fixed income managers undertake relative value analysis as part of their investment process. However, this is not the same as pure RV investing.

Conventional RV analysis involves comparing a range of similar bonds to pick the one offering the best value for the portfolio. For example, a fund may choose between many ‘BBB’ rated corporate bonds by undertaking conventional RV analysis to determine the one that offers the highest yield on a risk-adjusted basis or the fund may choose between a 6 year and 7 year government bond on the basis of which offers the highest yield relative to its interest rate risk.

The important differences between this type of conventional RV analysis and pure RV investing are the degree of subjectivity inherent in the analysis and the extent to which other market risks are present.

In the first example, there is a high degree of subjectivity involved in comparing the corporate bonds. Although they have the same credit rating and may be genuinely comparable (e.g. companies in the same industry), the bonds are not explicitly linked to each other because they are issued by different companies. This means their underlying risks can be very different in some scenarios and a highly subjective judgement call then needs to be made on their individual earnings outlooks, company specific idiosyncrasies etc.

By contrast, a pure RV investing approach, as applied to interest rate markets, focuses on securities that are explicitly linked and therefore have highly constrained and well-defined relationships between them. While these relationships are not always entirely objective, they are certainly far less subjective.

In the second example, the 6 and 7 year bonds are explicitly linked because they are issued by the same government and therefore reflect more similar underlying risks. This example is getting closer to pure RV investing in terms of the analysis, however the way in which the ultimate investment is undertaken remains different, as it will include other market risks.

If, for instance, it is decided to buy the 7-year bond because it is mispriced relative to the 6-year bond, the fund will get exposure to the RV mispricing but also get exposure to the interest rate risk inherent in that bond. The latter represents general market risk, is driven by highly variable macroeconomic factors that are hard to predict and will often overwhelm the RV component. This is particularly true in periods of market stress, when getting the directional macroeconomic calls wrong can lead to large losses.

By contrast, a pure RV investing approach may buy that same 7-year bond but then use specialised interest rate derivatives to precisely isolate the RV mispricing by explicitly stripping out unwanted market risks. This extra layer of complexity is what allows a pure RV approach to generate returns that are independent of broader interest rate fluctuations and macroeconomic factors.

This complexity is also a barrier to entry, as it makes pure RV investing a resource intensive approach, requiring specialised knowledge and infrastructure to implement. For these reasons, it is only practical to implement if the entire investment process is specialised to doing just this and tends not to work well if done on a part-time basis. Perhaps this why there are so few pure RV investing funds around.

Adopting a medical analogy, conventional RV analysis is akin to a what a really good general practitioner does, while pure RV investing is a niche surgical specialty.

Cutting through the technical nuances, the underlying principle is that macroeconomic factors and general market fluctuations are not the primary driver of returns from a pure RV portfolio. Instead, pure RV returns are largely driven by market inefficiencies, which are created by the buying and selling flows of a diverse range of market participants. (details here)

In fact, as counterintuitive as it seems, a pure RV portfolio can be invested with no view about which way interest rates, economies or markets are heading. This is precisely the opposite of how conventional fixed income portfolios are invested, as their returns are highly dependent on getting these types of macro-directional calls right, even for those who undertake conventional RV analysis.

Defensive pure relative value investing

A common assumption we come across when discussing portfolio construction is that a core defensive fixed income investment needs to have interest rate duration exposure. The underlying assumption is that when the equity side of the portfolio incurs losses, bond yields will fall and the interest rate duration exposure inherent in bonds will deliver capital gains to offset equity losses.

However, the experience of 2018, together with a longer history prior to the 2008 financial crisis, shows this assumption doesn’t always hold (details here) and even if it does, the payoff from that duration exposure will be small when yields are very low. (details here)

Another common assumption is that pure RV investing ‘seems risky’ given the complexity, use of derivatives, high turnover and perhaps, just because it’s unfamiliar.

However, depending how it’s implemented, a pure RV investment approach can consistently prove both these assumptions wrong. Specifically, the underlying pure RV strategies can be packaged to strictly control volatility and minimise exposure to varying market conditions, including extreme adverse scenarios.

This is done by prioritising risk diversification and risk balance. The former, by intentionally spreading risk across many modestly sized and independent RV strategies, to mitigate the risk of a single position overwhelming the portfolio. The latter, by intentionally including a mix of RV strategy types that can perform well in different scenarios, including larger allocations to ‘risk-off’ biased RV strategies that outperform in adverse scenarios.

The resulting portfolio is not reliant on a particular market scenario or forecast of economic data to play out and therefore can deliver consistently lower volatility returns than even a conventional passive government bond index, while also offering further upside potential in volatile or adverse market environments, when conventional investments may incur losses. It therefore achieves a core defensive fixed income objective, but without relying on duration or other conventional fixed income risk and return drivers to do so.

While conventional bond investing may feel safer because it is easier to understand and more familiar, it can come with just as much, if not more risk, and may not be as defensive as it seems on the surface.

For example, as interest rates globally have dropped to very low levels, conventional yield based bond portfolios have struggled to maintain returns. Many have responded the only way they can, which is to just take more and more of the same types of risk. As a direct result, the defensiveness of these portfolios has been compromised by increasing credit and liquidity risks. (details here and here)

The growing realisation about the changing nature of conventional fixed income risks means more investors are now becoming sufficiently incentivized to overcome the complexity hurdle in considering other options for their core defensive fixed income allocations.

Alpha vs. Beta

Currently getting a lot of attention are discussions around the benefits of active vs. passive investing, constrained investor fee budgets and what is genuine alpha that is deserving of higher fees vs. beta in disguise that can be replaced by cheaper passive options.

Discerning the latter in fixed income portfolios is complicated because even a single bond bundles together multiple risk factors and then a portfolio may hold hundreds of bonds that blend these risk factors in different ways.

While it seems that a portfolio with hundreds of different bonds should be highly diversified, the reality can be the opposite. Such portfolios may genuinely diversify away the idiosyncratic risk (i.e. the bond specific risks) but end up highly concentrated to the small number of risk and return drivers – yield, interest rate duration, credit beta and liquidity risk – that dominate the performance of conventional bond portfolios. (details here)

So, if performance is largely being driven by just these few market beta type factors, why not just replicate them cheaply with the appropriate passive indices?

For example, if an active bond fund consistently holds high allocations to credit securities and then outperforms because credit markets generally are doing well (i.e. credit beta is largely driving the performance), couldn’t a similar outcome be achieved more cheaply by investing in a passive credit index to replicate that credit beta factor?

In fact, this was precisely the conclusion of a recent paper on fixed income alpha vs. beta:

“Over the past 20 years, active fixed income (FI) managers have tended to deliver returns in excess of their benchmarks. This has generated a popular notion that active investing in fixed income markets is ‘easy’.

Our aim is to assess the veracity of that notion. Across a broad set of popular active FI categories, we find that passive exposures to traditional risk premia (especially exposure to credit risk) explain the majority of FI manager active returns.

The resulting implication is that, contrary to popular belief, traditional discretionary active FI strategies offer little in the way of true alpha, and that traditional active FI strategies may significantly reduce the strategic diversification benefit of FI as an asset class.”

– ‘Active Fixed Income Illusions’ ; Brooks, Gould, Richardson; Nov 2019

By extension, a fixed income investing approach that does not rely on the conventional fixed income return drivers and is instead exploiting return sources that cannot be reliably replicated using passive investments, may then have the strongest claim on offering genuine alpha.